Tax advantaged investment strategies are becoming a priority for high-net-worth investors…

Can I Lose Money in My ESPP Company Stock?

Employee stock purchase plans (ESPPs) are benefits offered by many publicly traded companies, which allow employees to purchase shares of company stock at a discount. We often get the questions – should we participate in our company ESPP; and if yes, how much should we contribute? The answer is, it depends but usually yes you should participate. The discount can vary from company to company between 5% to 15%. The bigger the discount, the more advantageous it is to participate. Generally companies allow these shares to be sold immediately, locking in the discount, which is why these plans are so attractive.

We also get the question: can I lose money in my ESPP company stock? The answer to this is a little more complex so we’ll use some examples to help clarify. ESPPs cannot be underwater in the traditional sense of having a purchase price greater than the current stock price. With an ESPP, the market price at the beginning of an offering does not completely control your actual purchase price. ESPPs with a discount and a lookback can be a good deal even in a down market, as you are getting the discount off the lower of either the start-date price or the purchase-date price.

Even if you do not have a lookback, you still get a discount off the market price on the purchase date.

Example: The stock price at the start of the offering is $14. The price on the purchase date is $10. The 10% discount applied to the purchase-date stock price results in a $9 purchase price. By contrast, if you had stock options that were granted with a $14 exercise price, they would be underwater with a stock price of $10.

For some, ESPP stock can offer special benefits in down markets. While volatility does not always matter, with most ESPPs, what matters is the stock price at the start of the offering period and on the purchase date. A big drop in the stock price during the offering period that mostly recovers before the purchase date does not affect your purchase price.

Example: Your company’s stock price is $14 on January 2, when the offering period starts. It falls to $9 by late March due to the impacts of the rising interest rates. On the purchase date six months after the offering start (July 2), the stock price has recovered to $13. The ESPP discount in the purchase price is taken off the $13 stock price on July 2.

The Bad News: Limits On The Amount Of Stock You Can Purchase

When your company’s stock price falls, you may not be able to purchase as many shares as you would like. It depends on the amount of your payroll contribution (e.g. 10% of your salary).

Under a tax-qualified Section 423 ESPP, the tax code lets you purchase a maximum of $25,000 worth of stock for each calendar year (see a related FAQ), though your company can set a lower limit. The value of your stock for this $25,000 limit is based on the stock’s undiscounted price when the offering begins, not at the purchase date. In the example above, you would be able to purchase up to 1,250 shares ($25,000 divided by $20), not 2,777 shares ($25,000 divided by $9 purchase price). This can mean that your company refunds any amount contributed for an ESPP purchase over $11,250 (1,250 shares at $9 per share). However, if your payroll contribution for your ESPP is usually this amount or less, the lower share price does allow you to buy more shares than you would be able to if the price rose during the purchase period.

Example to compare: You have contributed $11,250 of your salary for the next ESPP purchase date. The stock price is $20 at the start of the offering period and $25 on the purchase date ($10 on the purchase date in the bear-market example above). With a lookback provision for the price, at an $18 purchase price per share (10% discount from the $20 start price), you can buy with $11,250 only 625 shares. However, the actual discount off the market price at purchase is greater ($18 purchase price when the stock trades at $25 on the purchase date).

Special Plan Features In Down Markets

If its stock price has decreased by the purchase date, your company may have a rollover provision (sometimes termed a restart provision). During a long offering period (e.g. 24 months) with a six-month purchase period, a rollover automatically withdraws and re-enrolls you. This lets you take advantage of the lower lookback price, both for the $25,000 calculation and for when the market rises (hopefully) during the new full offering period. This restart feature may be automatic or at the discretion of your company.

Alternatively, your company may have an automatic reset. This type of provision is also triggered when the market value on the purchase date is lower than it was at the enrollment date. The lower price on the purchase date is reset to become the lookback price (no new offering period started).

Tax Confusion

ESPP taxation can be confusing, and even more so when your company’s stock price falls. When you satisfy the holding-period

requirements for tax-qualified ESPPs, you still have ordinary income for the portion of the gain equal to your company’s discount (e.g. 5%, 10%, or 15%) from the offering/start price, regardless of the actual purchase price for the stock and even if there is no lookback.

Ordinary income is this amount or the actual gain at sale, whichever is lower. When stock is sold at a loss, you have no ordinary income, just a capital loss. However, when you sell the stock early in a disqualifying disposition (sale immediately or within one year of purchase or two years of the ESPP start date), the spread at purchase is ordinary income regardless of the sales price. With this early sale, you can have ordinary income even though you have no actual gain.

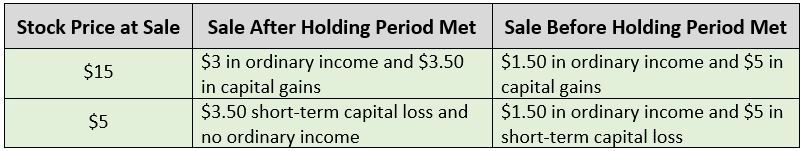

With a tax-qualified ESPP, the breakdown of ordinary income tax and capital gains tax can vary depending on when you sell the stock and its price. A volatile or falling stock price can create tax oddities. It is usually better to have capital gains than ordinary income, as capital gains can be netted against capital losses, and the lower capital gains rate applies for shares held more than one year.

Example: Start-date price $20, purchase-date price $10. The 15% discount results in an $8.50 purchase price.

Example with sale when stock price is $15: Hold long enough: have $3 in ordinary income (15% of $20 start price) and $3.50 in capital gain ($15 sale price minus ESPP stock that has $11.50 tax basis). Sell sooner: have $1.50 in ordinary income ($10 market price at purchase minus $8.50 purchase price) and $5 in capital gain ($15 sale price minus ESPP stock with $10 tax basis). In this situation, where the stock price rose after the purchase date, the early sale results in more capital gain income than the sale after one year did.

Example with sale when stock price is $5: If you wait to sell the stock until one year after it drops to $5, you will have a $3.50 short-term capital loss and no ordinary income (when the loss is greater than ordinary income, it is all capital loss). If you sell before one year elapses, you will have $1.50 in ordinary income and a $5 short-term capital loss.

These example results are summarized in the table below.

As you can see, this can be more complicated than you might expect. To learn more about the potential benefits of ESPPs with a falling or volatile company stock price, including the tax treatment, schedule a meeting with us as we are happy to help.

Source: Forbes; MyStockOptions. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.