How does the stock market perform during an election year? Does it matter which party wins the Presidency? See what the data says.

How To Pay Less Tax On Company Stock Sales

Nobody loves taxes, but as the saying goes – only two things in life are certain….. If you are fortunate to have been granted shares in your company, sooner or later a decision must be made about how to best capture the value of your grant. Any shares you acquire from equity compensation must be sold to realize the financial benefits of your stock grants. These could be shares that appreciated substantially from a stock option exercise, restricted stock/RSU vesting, or ESPP (employee stock purchase plan) purchase long ago. They could be founder’s stock or shares from equity compensation in a startup that later turned into a hot IPO company.

While most investments held over one year qualify for the favorable tax rate on long-term capital gains, the total capital gains tax can still be significant. However, it’s very important to keep in mind that there are some planning strategies, depending on your income, financial goals, and even life expectancy, that allow you to defer or pay no capital gains tax. This can maximize the benefits of your grants and let you retain more wealth as you plan for the future.

Most of these strategies to defer or eliminate capital gains tax are considered tax expenditures which are tax-code provisions created to encourage certain activities or benefit certain categories of taxpayers. Below we highlight a few of these provisions but we strongly encourage you to seek advice from a financial or tax planner on your personal situation.

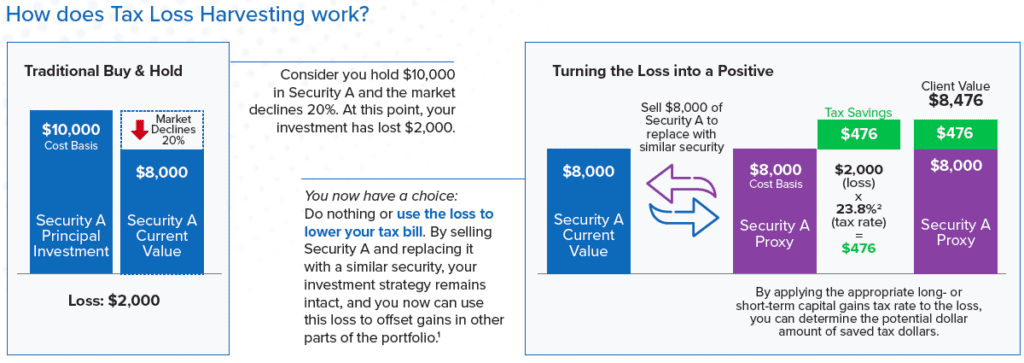

1. Tax Loss Harvesting

If you’re not doing this already, you probably should be. Capital losses of any size may be used to offset capital gains on your tax return to determine your net gain or loss for tax purposes. This could result in no capital gains at all to tax. Tax-loss harvesting is a popular strategy and it can also be of benefit when selling other assets at a gain such as real estate or a business. While only $3,000 of net capital losses can be deducted in any one year against ordinary income on your tax return, the remaining balance can be carried over to future years indefinitely. Should you follow this strategy in harvesting losses, you want to be extra careful to avoid the rules about wash sales should you plan to soon repurchase the same stock or related security.

2. The 10 – 12% Tax Bracket – Be Careful

For investors in the 10% or 12% income tax bracket, the long-term capital gains rate is 0%. Under the Tax Cuts & Jobs Act, which took effect in 2018, investor eligibility for the 0% capital gains rate is not a perfect match with the income ceiling for the 12% income tax rate. The income thresholds for the 0% rate are indexed for inflation:

- in 2021, $40,400 (single filers) and $80,800 (joint filers)

- in 2022, $41,675 (single filers) and $83,350 (joint filers)

If you believe you qualify for this special 0% capital gains rate, or think you can shuffle your stock to someone else in a lower tax bracket who can sell to get the 0% rate, you want to be sure you follow the tax rules. For example, the net gains from your stock sale count against the income limit. Should you decide this is a good year to convert a traditional IRA to a Roth IRA, that income counts, too. The kiddie tax is triggered should the gifted stock be sold by a child under the age of 19 (for full-time students, under the age of 24).

3. Stock Donations and Donor Advised Funds

Are you planning to make a big donation to a qualifying charity? Instead of selling the appreciated stock, paying the capital gains tax, and then donating the cash proceeds, just donate the stock directly. You can likely avoid the capital gains tax completely. Plus, this planning approach typically generates a bigger tax deduction for the full market value of donated shares held more than one year, and it results in a larger donation.

With donations that put you over the yearly standard deduction amount, the stock donation also reduces your overall taxable income. You could donate the shares to a donor-advised fund if you’re uncertain about your philanthropic goals for all the stock. Depending on your level of wealth, you may also want to consider a charitable remainder trust or private foundation.

4. Dying With Appreciated Stock

Sure, this may seem like an extreme planning technique, please don’t stop reading and hear us out. First, it’s important to understand how this works. The standard calculation for capital gains in your retail brokerage account (not securities in a 401(k), IRA, or other tax-qualified retirement plan) after commissions and fees is:

capital gains = sale proceeds – cost basis [purchase price of stock]

Should you sell the stock during your lifetime, the net proceeds in this equation are your capital gains (or losses). Should you gift the stock, the cost basis carries over to the new owner.

If you pass away before selling or gifting, this cost basis in most situations is “stepped up” to the fair market value on the date of death. This allows the stock to escape the capital gains tax on the price increase during your lifetime, regardless of the size of your estate. Any potential capital loss deduction also goes away should the stock price have dropped since purchase. Thus, no taxable gain is recognized when the inherited shares get sold at no higher than the death-date price.

In Summary

Each stock grant is unique and comes with its own intricacies. The owner of each stock grant is also unique with regards to their financial status, tax bracket and financial goals. Above we have just listed a few of many advanced planning strategies related to company stock and taxes that may be appropriate for you. For now, we hope you find these popular strategies insightful as you ponder what’s the right solution to capturing the value from your stock grant.

If you would like to speak with us about these solutions, or learn about other strategies, that would best suit you – feel free to schedule a meeting or send us a message. We’re here for you and happy to help.

Sources: Blackrock, 55ip, MyStockOptions.com. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.