"Do not mistake a confident explanation for an accurate prediction" - James Clear. It's important to remember this when reading the news.

Chasing Returns and Hot Sectors

If we were to compile a list of “Biggest Mistakes Investors Make,” at the very top of that list would be “chasing returns.”

Individual investors have a tendency to jump from one sector to another. They’re always trying to get in on whatever corner of the market has been hottest lately. While the broad stock market has historically chugged along on its upward (sometimes bumpy) climb, the various sectors of the market tend to rise and fall like horses on a merry-go-round.

Why can’t we get off the merry-go-round?

When one particular market sector rotates into favor, as large tech stocks have in recent years, it becomes the focus of the Wall Street hype machine. Why? Quite simply, it’s an easy sell. Investors want to believe it makes sense to pile into whatever stock or sector is hottest at the moment. Fund companies, brokerage houses and the financial media are all too happy to sell them that dream.

The problem is, the dream often doesn’t persist for long. The very fact that millions of investors pile into the sector du jour sends share prices soaring. This creates a feedback loop where the higher those stocks climb, the more investors chase those returns, and the higher the stock prices continue to climb.

But the party can’t last forever. As these share price run-ups raise price-to-earnings (P-E) ratios for the hottest stocks well beyond that of the broad market. That’s exactly what we’ve seen recently with the best-known tech stocks. All have price-to-earnings ratios well above the S&P 500 index, as seen in the table below (as of 10/6/23):

| Stock | P-E Ratio |

| Apple | 30.08 |

| Amazon | 100.99 |

| Alphabet (Google) | 29.56 |

| Meta (Facebook) | 37.09 |

| Netflix | 41.10 |

| S&P 500 Index | 19.42 |

At some point there is a reckoning, as the reality of those companies’ earnings will eventually have to make sense when compared to their share prices. Outsized valuations put tremendous pressure on companies (no matter the size) to continue to grow earnings exponentially to justify their lofty stock price. If they don’t, the market will re-price them accordingly.

That doesn’t always happen quickly, but it does happen eventually if those companies can’t keep up the pace with their earnings. The reckoning can be brutal! In 2021-22 stocks like Meta and Netflix plunged more than 70% from their post-Covid highs. Investors who arrived at the party too late experienced devastating losses they may not recover for years.

A Lesson from Large Caps

Unlike narrow market sectors such as technology, transportation, etc., broader asset classes often experience prolonged periods of both leading and lagging the overall stock market. This can make it particularly hard for diversified investors to be patient. Such time periods can come to seem like a permanent state of affairs after a few years.

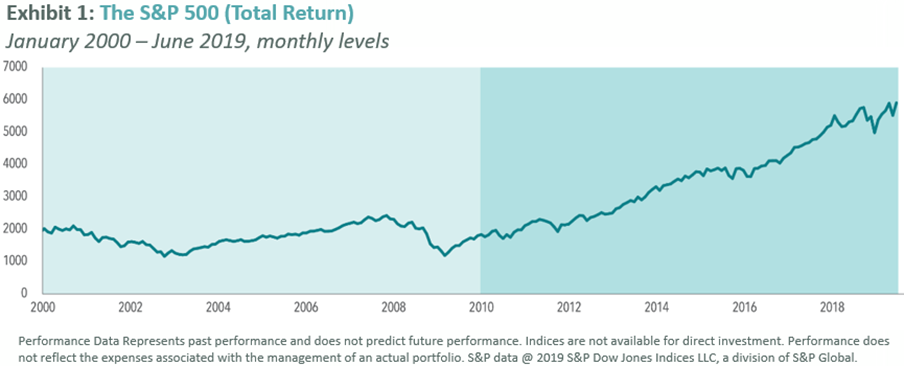

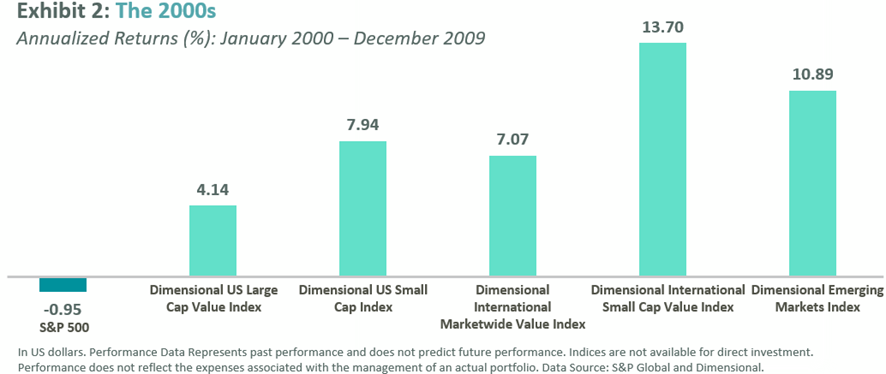

That’s what happened with large cap U.S. stocks during the 2000s, when the S&P 500 actually posted a negative return for that entire decade. Yet, perhaps unsurprisingly, the S&P pulled out of that slump and led the market during the 2010s.

It’s easy to see how it all worked out in hindsight, but it certainly didn’t feel that way in real time during the 2000s, which saw the S&P 500 experience two of its worst bear markets in history on the way to a 10-year total return of -0.95%:

These prolonged time periods, when one asset class underperforms the broad stock market, can be extremely painful for those who are concentrated in that particular asset class. Few investors can afford a full decade of negative returns. This is why those who choose to just buy an S&P 500 index fund (or any other asset class) are assuming significant long-term risk compared to diversified investors.

Reducing the Risk

As a fee-only Registered Investment Advisor, we have a fiduciary obligation to recommend the investment strategies we believe work best for our clients. If there was sufficient evidence that diversification was no longer an effective strategy compared to other approaches, then we would not hesitate to recommend those strategies to our clients.

In the absence of that, we strongly believe that a diversified, evidence-based investment strategy built on the principles of sound diversification remains the best way to invest.

Disclosure

Sources: Marketbeat.com, The Wallstreet Journal, Dimensional Fund Advisors. Historical performance results for investment indices, benchmarks, and/or categories have been provided for general informational/comparison purposes only. Past performance is no guarantee of future results.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.