We’ve said before that the most dangerous four words in investing…

Day of the Dead Portfolio – The 60/40

One of the oldest pieces of financial advice is to build a 60/40 portfolio: 60% equities and 40% bonds. In this set up, equities would offer investors exposure to higher returns when the economy is growing. On the other hand, the low-risk, low-reward bonds would provide income as well as stability even in economic downswings, offsetting the former’s volatility.

Given these assumptions, the 60/40 portfolio would theoretically be fairly consistent, providing exposure with minimal volatility and higher income — but if that were all still true we wouldn’t be writing this article. In the face of ultra-low interest rates and the rise of alternatives, learn how you may be able to start building a portfolio for today’s economy rather than the past’s.

The issue with bonds

Before we explore some possible alternatives to bonds, it’s important to understand exactly what happened to this time-honored investment strategy.

The COVID-19 pandemic caused central banks globally to lower interest rates to levels comparable to those seen during the financial crisis of 2008. As Kiplinger explains,these interest rate cuts gave bond prices a tailwind,however investors should not expect a repeat performance in 2022. So, when we compare an index of investment grade bonds to the U.S. 10-year Treasury yield, you’re looking at less than an additional 1% compensation for taking on more credit risk.

Translation? If 40% of your portfolio is only expected to earn about 1.9% for the next few years, your stocks are going to have to work that much harder. However, the 60/40 portfolio isn’t the only financial strategy being impacted by lower interest rates. The 4%rule, a popular strategy to gauge withdrawals from an investor’s retirement portfolio,won’t work as well in the coming years due to lower projected stock and bond returns.

With all of this in mind, there are still several ways you may be able to navigate market volatility in the years to come.

Non-correlated alternatives help navigate market volatility

An alternative investment is a financial asset outside of stocks, bonds and cash, each of which come with their own unique characteristics. While these options all can introduce new risk – illiquidity and less regulations, just to name a few – the risk-return trade-off can be worth it. Let’s go over some of the most common:

Private Debt

Private debt – also known as private credit – is a private capital strategy in which investment managers and institutions invest by making private, non-bank loans to companies. These loans are not available via publicly traded markets, and they generate returns for investment managers and their private debt fund investors via interest payments. One of the main appeals of private debt is it’s low correlation with the public market.

The Global Financial Crisis spawned new regulations that drove banks to shrink balance sheets and pull back on lending. Non-bank lenders, such as private debt funds, have filled the void.

As an income-focused asset class which has exhibited less volatility and relatively low correlation to other fixed income asset classes, private debt can fit well into a range of portfolio types from a portfolio construction standpoint. We believe private credit is an attractive alternative to traditional fixed income, including high yield, for several reasons. High yield is a fixed-rate

instrument, which in rising interest rate environment will likely lose value if all else held equal. Private credit, in contrast, is primarily floating rate, meaning the interest rate is structured as a spread over a base rate so greater protection from rising interest rates. Additionally, private debt is senior secured in the capital structure with stronger covenants and protections, so it could better shield investors in the event of economic weakness. High yield is more junior in the capital structure, so it is more

exposed to credit risk in the event of a default.

Keep in mind that private debt is an illiquid investment, so as an investor you can’t easily flow in and out of the transaction. This unique liquidity (holding period) risk tends to come with more attractive investment returns, making the decision truly dependent on your personal risk tolerance.

Private Equity

Private equity investments typically aim to create value in private businesses by financing growth, operational improvements or other changes. Combined with active ownership, longer time horizons and financial leverage, those changes may produce higher returns than are common in public equity.

Private markets represent a large and growing opportunity set that cannot be found in public markets alone. Take the number of U.S. companies that produce revenue of $100M or greater – 86% of those companies are private, while only 14% are public companies1.

Like all these other private asset classes, private equity also is less liquid and generally has a longer investment timeline. Due to these additional risks, private equity should be assessed to determine if it fits your needs and goals.

Private Real Estate

Many people unknowingly already have real estate exposure by owning a home. However, if it’s your primary residence, you can’t earn income from your home while living in it (unless you do short-term rentals). With real estate being the 3rd largest asset class after fixed income and equities, most people need to add real estate in their investment portfolio. Unlike stocks or bonds, real estate is both income-oriented and capital appreciation-oriented.

Thought of buying property and being a landlord? That’s what we consider an active investment – you must take an active part in the investment to see a return. If you want real estate exposure in your investment portfolio but don’t want to actively manage a property, your options are publicly traded REITS or private real estate.

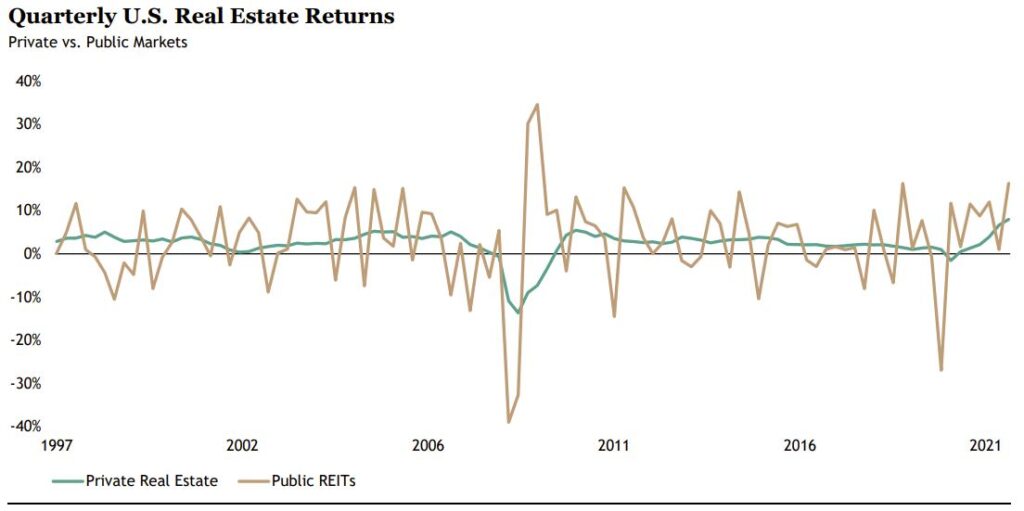

Why choose private real estate over publicly traded REITS? Private real estate has exhibited 71% less volatility than publicly traded REITs based on the annualized standard deviation of the NFI-ODCE Index relative to the MSCI U.S. REIT Index for the 25-year period ending June 30, 2022.2 Private real estate can offer consistent tax-advantaged distributions and appreciation potential with lower volatility. Private real estate may also offer diversification benefits and serve as a hedge against inflation.

You may be noticing a pattern with all these private investments – they’re not publicly traded on an exchange and therefore, they have less liquidity than public entities. Private real estate is the same.

Diversifying into alternative investments can help investors address some of the risks in the stock and bond markets today, including elevated inflation and lower yield. As you look toward alternatives to diversify and drive yield, keep in mind that these options carry their own risks which can vary from traditional stocks and bonds. Every investment should be uniquely considered on an individual basis to ensure it’s suitable for your investment needs and goals.

Looking toward the future

As you plan for your retirement and consider ways to protect your portfolio in the years to come, it can feel overwhelming trying to determine the right mix for your financial goals. A financial advisor can help you to better understand your options and create a strategy aligned with your unique needs.

Sources: BlackRock1 Capital IQ, BlackRock as of 3/21/22. Represents the number of companies with annual revenues greater than $100 million.

Blackstone 2 As of June 30, 2022. Represents BREIT’s view of the current market environment as of the date appearing in this material only. The property value of private real estate may fluctuate. See “Important Disclosure Information-Trends” and “Important Disclosure Information-Index Definitions”.

Blackstone 3. As of December 31, 2021. Represents BREIT’s view of the current market environment as of the date appearing in this material only. The property value of private real estate may fluctuate. Private real estate has exhibited 70% less volatility than public REITs based on the annualized standard deviation of the NFI-ODCE index relative to the MSCI U.S. REIT Index for the 20-year period ending December 31, 2021. Appraisal-based valuations of private real estate may be subject to smoothing bias and may therefore reflect lower volatility than would the valuation of public entities traded on an exchange. See “Important Disclosure Information–Trends”. Morningstar Direct, NCREIF. Past performance does not guarantee future results. There can be no assurance that any Blackstone fund or investment will be able to implement its investment strategy, achieve its investment objectives or avoid substantial losses. An investment in BREIT has material differences from a direct investment in real estate, including related to fees and expenses, liquidity and tax treatment. Private real estate is represented by the NFI-ODCE and reflects total returns excluding management and advisory fees. Public REITs are represented by the MSCI U.S. REIT Index. See “Important Disclosure Information–Index Definitions”.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.