Tax advantaged investment strategies are becoming a priority for high-net-worth investors…

Empty Nest – Time to Reevaluate

Has your last child launched into adulthood and independence? Congratulations! This is every parents hope and wish for their child – that they can one day become a self-sufficient contributing member of society. These next few months and years will be very important for them, and for you as well. You are now an “empty nester” – so what will change?

This is absolutely a time to enjoy a slower quieter pace of life than the busy shuffle you’ve been doing for the last few decades. You might pick up a new hobby, do some traveling you’ve put off or re-engage with friends and groups you didn’t have time for while being an active parent. Those are all great things to fill your new found time.

This is also a great time to reevaluate many things in your life. You’ve been so focused on your family and your child. Their future, their goals and needs. Now is the time to step back, look at your financial situation, and see if any changes or work needs to be done. Many empty nesters tend to spend most of the new-found slack in their budget, rather than save it, a choice that will undermine their retirement security.

Not sure where to start with reviewing if any changes are needed? This list may help:

- Emergency funds

You’ve been so focused on paying for your child’s needs – housing, food, health, education, travel and wants. Do you have enough in an emergency fund if you had an unexpected event arise? When your A/C goes out in the middle of summer, you want to make sure you have enough cash on hand to replace it ASAP. We recommend having 3 – 6 months worth of your expenses saved in a high-yield savings account. Right now rates are high, so your cash will be earning interest while reassuring you an emergency can be covered. - Retirement contributions

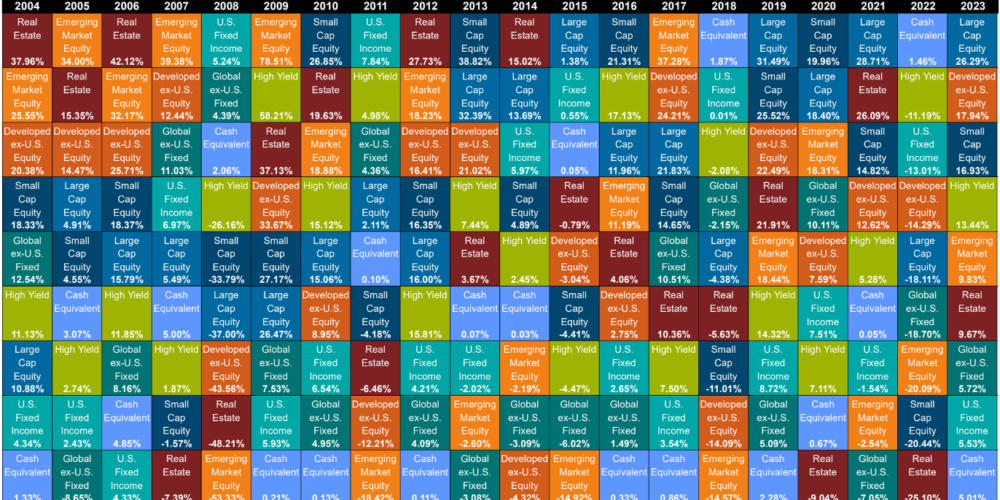

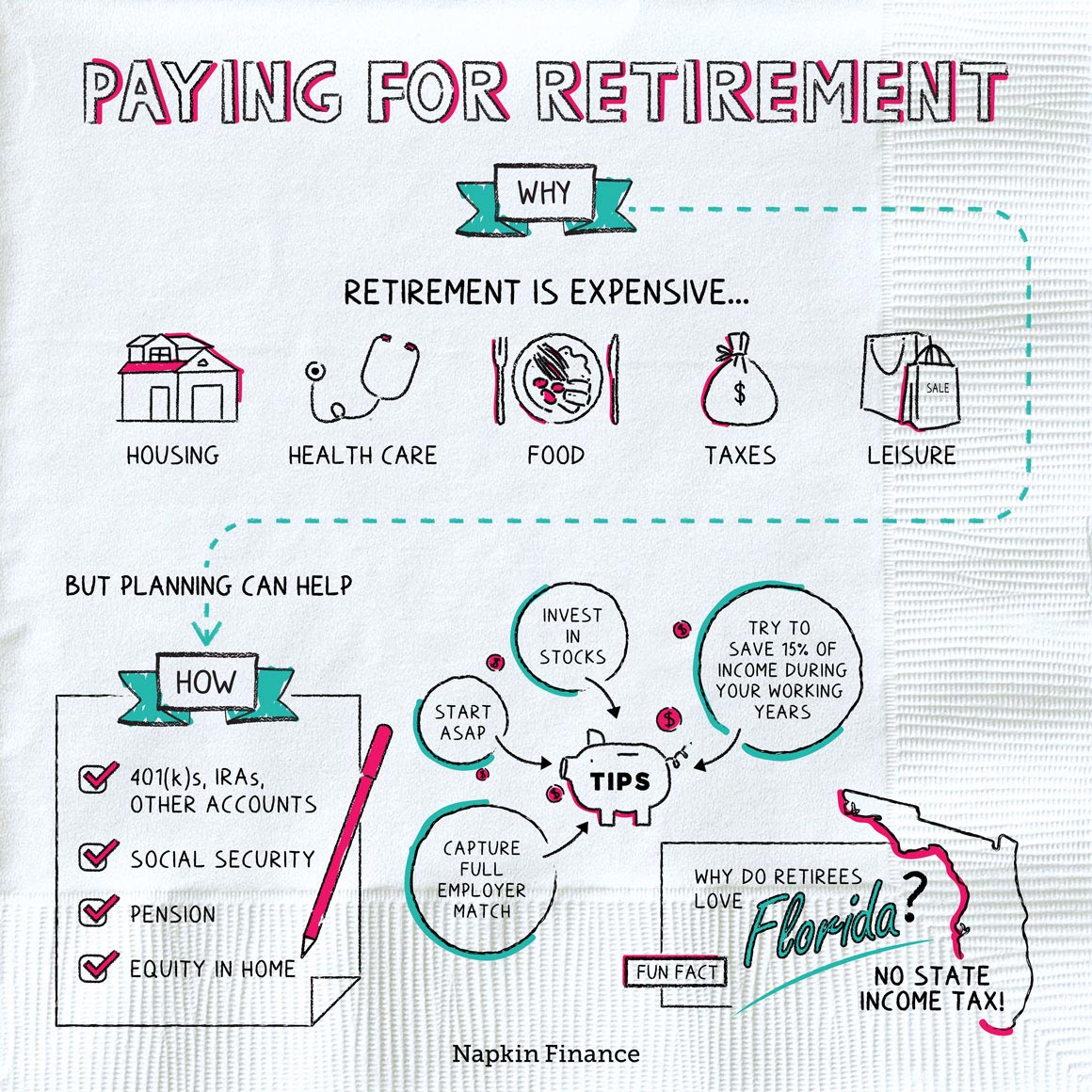

Working parents in their 50s and 60s are ideally positioned to accelerate their retirement savings. You’re at the peak of your earnings – the mortgage may be close to paid off and hopefully your kids are financially independent. This is possibly your final chance to ensure your retirement is financially stress free, directing more into retirement savings should be a top priority.

To boost your retirement savings appropriately, you may need to rethink your current priorities – including taking the difficult step of reducing or even eliminating financial assistance to your adult children. Think of it as putting the oxygen mask on your face first. It may feel counter-intuitive, but, after all, your security in retirement is something your children want for you, too. - Health savings

Health care costs are increasing every year, and as you get closer to retirement, your health needs may increase. You may also want to retire before Medicare is available to you at the age of 65. Participating in a high deductible health plan now will allow you to contribute to a health savings account (HSA). An HSA works like a bank account AND an investment account. It is also triple tax benefits! The money you contribute is not taxed. The money you take out is not taxed when used for medical expenses. And the interest earned on your invested money is not taxed! The money is also yours, no matter if you quit, change employers or don’t use it at year-end. Don’t have a long-term care plan? This could be it if you start contributing the max now. - Tax planning

If your child is fully independent now, they will most likely not be eligible to be claimed as dependents on your taxes any more. This will affect how much you pay in taxes, so you may want to look for other deductions you can take to help off-set this lost benefit. For example, you might be able to deduct medical and dental expenses or a home office. A tax professional can help identify other ways to save. - Insurance

It’s always a good idea to review your insurance coverage every other year to ensure you have enough. Becoming an empty nester is also a good time to review who and what is covered under your policies. Your child can still be on your health insurance until the age of 26, after which point they’ll need to find their own. Unlike healthcare, there is no age limit for them being on your auto insurance, as long as they live at your house. If you are now an empty nester, that means they are not living with you and they will need their own policy.

You may also want to review your life insurance policies. Since your children are now self-sufficient, you most likely do not need as much coverage. This means that when your current term policy ends, you may not need to renew it or you can get a new one for a much lower amount. If you’re paying extra through your employer, you can shift that extra payment from life insurance to your work retirement plan or an HSA. - Housing

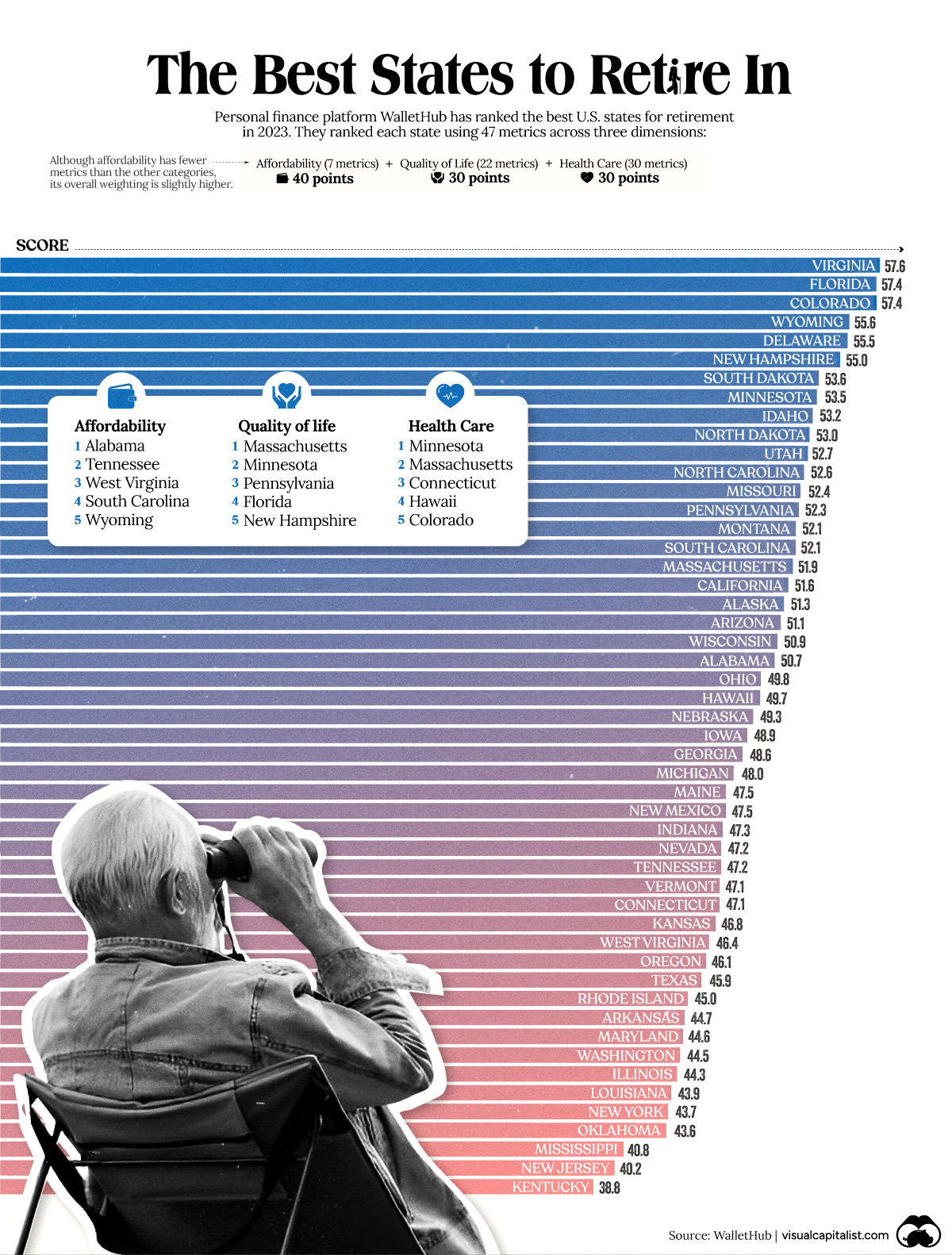

Leaving the home your kids grew up in can be really hard. So many memories, milestones and love was poured into that house. Now that they’ve moved out, it might feel very empty – too empty. This could be the right time to downsize or possibly even move cities or states. Choosing a new location could be for financial benefits, like a lower tax rate or cost of living. But a new location may also provide a better quality of life or health care benefits.

Transitioning to an empty nest household comes with lots of emotions, changes to schedules and life styles, and financial circumstances. The key to this transition, at least from a financial point of view, is all about finding balance, and staying focused on your long-term money needs.

Enjoy the peace and quiet of your new home arrangement, and any extra cash that comes with it. But also be mindful of your financial goals, and make sure you’re using a good chunk of that extra cash toward a happy, comfortable retirement – or you might wind up living in junior’s home some day, in a nest that’s not your own.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.