Weight Watchers, the iconic American health and wellness giant, filed for…

Five Technology Behemoths

If you want to see, perhaps even enjoy, an exercise in futility, run a search in Google on this phrase: 2019 predictions about the stock market in 2020

As you’ll find, the search returns dozens of articles containing hundreds of predictions from market pundits about how they expected 2020 to unfold for the economy and the stock market. Some were bullish, some bearish. Some predicted a recession, others a continued economic expansion. Nearly all boldly predicted some “periods of volatility” for stocks – mostly due to 2020 being a presidential election year.

What you will not find in any of these articles is a single prediction that an unprecedented pandemic would shut down the world for months, tanking the global economy and sending the stock market down more than 30% in the span of just four weeks. Nor will you see any predictions of the historic recovery in stocks that followed.

To be fair, it’s hard to fault these failed fortune-tellers from just 10 months ago. It wasn’t until December 31, 2019 that China first notified the World Health Organization of a mysterious, pneumonia-like virus emerging in the Wuhan region of China. It would be another month before U.S. health officials confirmed human-to-human transmission of the new virus. And it wasn’t until February 11 of this year that this novel coronavirus was given a name: Covid-19.

Yet, while we can’t blame any market pundit for their failure to predict the seismic impacts of a pandemic no one could have seen coming at the time – that’s also the point.

PREDICTIONS CREATE CURIOSITY

In retrospect, predictions about the short-term direction of the stock market seem harmless enough. Whether they turned out to be right or wrong is little more than a curiosity. But in the present, when the future is a murky mystery, they have an impact. We are bombarded with predictions from the so-called experts about the stock market on a daily basis, and in real-time they often seem compelling. They are blasted constantly across websites and news networks and into the consciousness of the investing public. Rightly or wrongly, many investors view these predictions as guidance; it influences their worldview, and, as a result, their decision-making.

This dynamic was on full display in the midst of the stock market plunge in February and March of this year, when all the experts who didn’t predict the pandemic a few months earlier were rushing, undaunted, to issue new predictions. They warned of deeper market drops yet to come, and a plodding “u-shaped” recovery for stocks that would take years to climb out of once the bear market finally ended.

STAYING IN YOUR SEAT

Unfortunately, investors heeded these warnings and headed for the exits. According to Morningstar, Inc., they pulled $326 billion from mutual funds and ETFs in March – more than three times the amount of outflows the industry saw in October 2008. In the same month, investors plowed a record $685 billion into money-market funds – just in time for the massive stock rally.

It’s a story as sad as it is predictable because we’ve seen it happen repeatedly in the past three decades. We can only hope that one-day individual investors will finally realize how baseless these short-term market predictions are, and how much their net worth declines whenever they heed them.

It seems the rapid recovery in stocks since late March has been met with more skepticism than optimism. How could stocks have been on such a staggering upward climb since the early stages of the pandemic, with the economic impacts of the shutdown just beginning to be felt and the ultimate human impacts of Covid-19 far from certain? The rebound is generally attributed to stocks being propped up by the enormous relief packages enacted by Congress and accommodative fiscal policy from the Fed.

Indeed, there’s no denying that the stock market typically responds favorably to spending bills and easy money policies. But it’s also interesting to look under the hood, so to speak, and take a closer look at the stocks that have powered the S&P 500’s almost 50% gain since the market bottom on March 23.

As we saw through early July of this year, the S&P 500 index’s performance in 2020 has been heavily skewed by the 50 largest stocks in that index – and especially by the 10 largest stocks. Beyond that (as of the July date used in our analysis), the remaining 450 stocks in the index had negative returns, with the bottom 50 stocks down nearly 40% on average. It seems the index remains skewed in a similar state.

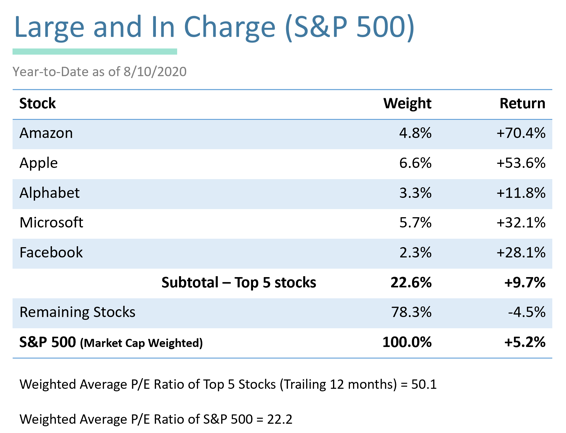

In fact, an even deeper dive into the S&P 500’s performance this year shows the rebound has been attributable to five technology behemoths: Amazon, Apple, Alphabet (Google parent company), Microsoft and Facebook:

Sources: slickcharts.com and Yahoo Finance

Because these five stocks account for 22.6% of the S&P’s total market capitalization, their outsized performance has buoyed the index in 2020 despite the vast majority of its component stocks being in the red.While the performance of those five big tech stocks has been impressive so far in 2020, they also carry significant risks going forward – namely in the stratospheric valuations these stocks now carry. As seen in the prior chart, the weighted average price-to-earnings (P/E) ratio of those Big 5 tech stocks was 50.1 as of August 10, compared to 22.2 for the remainder of the S&P 500. By comparison, small value stocks had an average P/E ratio of 12.20 as of June 30.

None of which is to say that any or all of these bellwether tech stocks are headed for a decline – just that their present valuations will require huge earnings going forward to justify their recent performance. Investors who are heavily concentrated in them are bearing the risk that comes with those lofty valuations – knowingly or unknowingly.As always we are here to help.

Best,

CAM Investor Solutions

Source: Bloomberg; Slickcharts; Yahoo Finance; Morningstar, Inc.; Capital Directions; M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC-registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding the fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.