It’s been said that the stock market does not like surprises…

Roth Conversions are a Big Deal

It is no secret 2020 took the world by surprise and will be the year we all remember. It also seems investors have learned there are many things we certainly cannot control. However, when it comes to financial planning, and in particular tax and retirement planning, there are significant opportunities we all should consider now since they may not be available for long. If you haven’t considered Roth conversions before, 2020 may be the year.

Why 2020? It’s because we have historically low tax rates and some have suggested they could rise in the near term. Taxes could also rise due to the increasing budget deficit, increased stimulus spending and highest deficit since World War II. For those whose employment has been impacted by the Covid-19 pandemic, this may present planning opportunities. And the obvious may be that higher tax rates put tax-deferred retirement savings at risk; so some of us may want to pay off the “debt” at the lowest possible tax rates.

KEY CONSIDERATIONS:

Assess overall market conditions and factors to determine if a Roth IRA conversion makes sense.

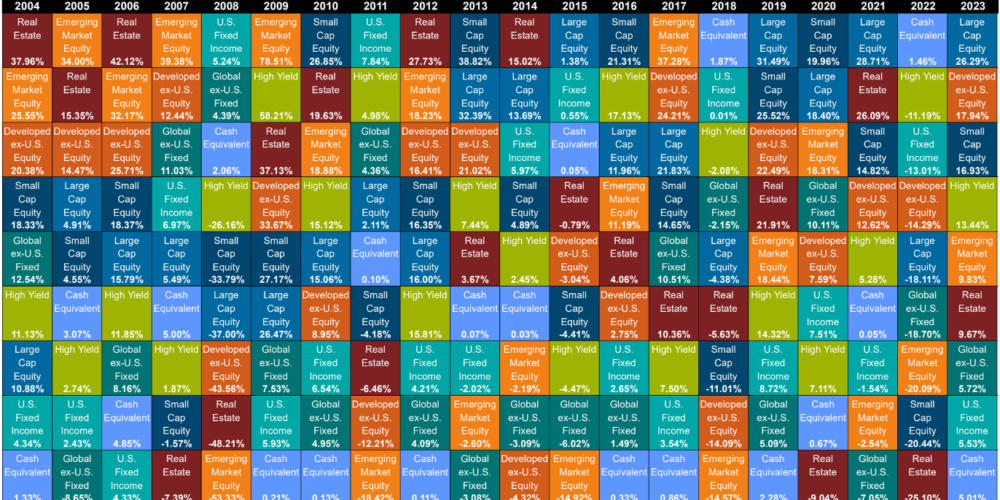

Determine which group of assets and/or asset class to convert.

Work with Advisor or CPA to determine the amount to convert.

Determine how you will pay the income tax on the conversion.

Compare other viable long-term tax planning strategies.

NEXT STEPS

Evaluate your need for a 2020 tax conversion. One option is to perform a series of smaller annual conversions over time. This fills up the lower tax brackets each year and manages the tax liability. Also, be sure funds are available to pay the taxes.

A second option is to convert larger amounts in 2020. By now, you should have a reliable estimate of 2020 income. If the pandemic caused business losses, a job status change from retirement or unemployment, or a large change to income, this year may allow for a larger conversion.

This popular planning strategy can allow you to pay lower tax rates today and allow the funds in your Roth IRA to grow tax-free. It can also allow for the potential for 100% tax-free withdrawal from your Roth in the future.

While a Roth IRA conversion can remove some risk of uncertainty to your planning process, keep in mind your Roth is not subject to required minimum distributions (RMDs). Smaller RMDs can reduce tax liability and increase sustainable lifetime income.

The benefits can be significant, but this strategy is not for everyone.

As always we are here to help.

Best,

CAM Investor Solutions

Source: AICPA; M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.