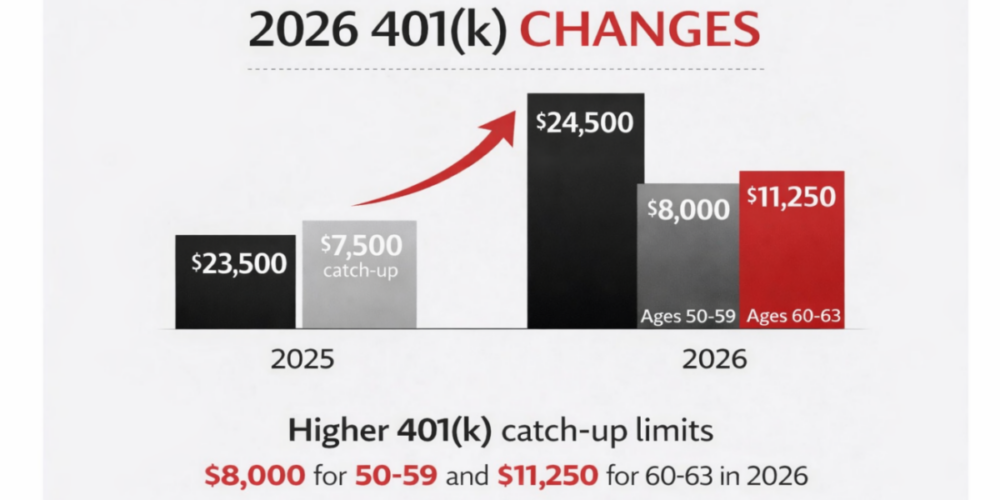

Tax saving strategies 2026 go far beyond higher 401(k) limits. For…

How Are Investments Taxed?

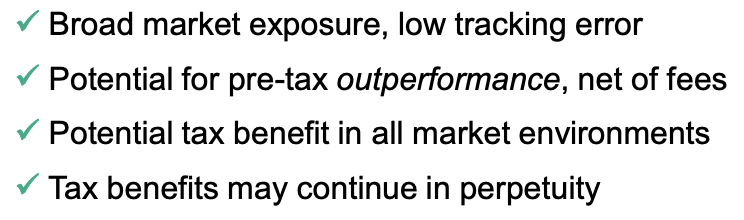

Investing can be an excellent long-term strategy for growing wealth, but navigating the taxes associated with investing can be complicated and frustrating. Nonetheless, failing to do so efficiently can have a negative impact on your after-tax earnings—potentially a significant one over time. Knowing how your assets are taxed might inform how you manage your portfolio, from which securities you invest in, to which accounts you hold them in.

To help you better understand how and when the IRS taxes your investment income, this guide breaks down the relevant tax regulations for financial assets, what the differences between them are, and how you might minimize your income tax liability in

the future.

What Exactly Gets Taxed?

Similar to your working wages, the IRS imposes income taxes on the money you earn from your investing activities, but the rules and rates surrounding these activities differ in a few key ways. Here’s a summary of the three most common types of investment

taxes.

1. Dividends

When companies generate excess capital, they can either reinvest these earnings into the organization or distribute them to shareholders in payouts called dividends. Dividends are popular among investors because of their potential to provide a

consistent and passive revenue stream. With non-dividend-paying stocks, it’s often not until you sell the stock that you realize a profit. In contrast, dividend-paying stocks can deliver returns—albeit modest ones—on a monthly, quarterly, or yearly basis.

Not all dividends are the same, though.

There are two primary types of dividends:

- Qualified dividends receive preferential tax treatment. They’re subject to a rate that’s often lower than your federal income tax rate: either 0%, 15%, or 20% depending on which tax bracket you fall into. These rates are consistent with capital gains rates, which we’ll discuss more a bit later.

- Non-qualified dividends are not afforded special tax treatment—they’re taxed as ordinary income under the standard federal income tax rate. Since non-qualified dividends often entail a higher tax burden, they’re generally considered less valuable than qualified ones.

Every year, you’ll get a Form 1099-DIV that details how much you received in dividends over the course of the previous year and whether they were qualified or non-qualified. Even if you reinvested your dividends and therefore didn’t receive any cash, they must still be reported.

To avoid being burdened by a hefty bill come tax season, consider proactively setting some money aside to fulfill your dividend tax obligations each year. If you’re looking to cut down on your dividend taxes or defer them until retirement, it could be beneficial to hold your dividend-paying securities in a retirement account like an IRA, 401(k), or one of their Roth variants.

2. Interest

The income you earn from savings accounts and interest-generating securities like bonds is taxable as ordinary income. As a result, you’ll be required to report, and pay taxes on, whatever interest you receive and you’ll have to do so at your federal income tax rate. Interest on individual securities is documented in Form 1099-INT, while interest you receive through a fund is documented in Form 1099-DIV.

One notable exception is that any interest earned on bonds issued by the US government (otherwise known as treasuries) is exempt from federal income taxes. Many municipal bonds are also exempt from federal and state income tax, though this

interest must still be reported when filing your taxes.

3. Capital Gains

A “capital gain” is the profit you earn from selling an investment, such as a stock or real estate property. Any time you sell an asset for a profit, you incur capital gains taxes—and this is also true for indirect investments, such as mutual funds, exchange-traded funds (ETFs), and limited partnerships. To illustrate, if you bought a stock for $100 and sold it for $150, the IRS levies a fee on the $50 profit.

Capital gains can be categorized either as short-term gains or long-term gains, and they’re taxed at different rates. The rate that’s assessed will be a function of how long you owned the asset before selling it.

- Long-term capital gains are triggered upon the sale of an asset held for longer than a year. For 2022, the tax rate you pay is 0%, 15%, or 20% based on your total taxable income and filing status.

- Short-term capital gains are triggered upon the sale of an asset held for less than a year and are taxed at the standard income tax rate.

Because regular income tax rates tend to be higher than those for long-term capital gains, holding your securities for at least a year can provide you with preferential treatment when it comes time to sell.

Strategies to Manage Taxes

To help you better navigate the upcoming tax season, here are four tips that may help you manage your end-of-year tax obligations:

-

Within reason, consider reducing the number of times you trigger a capital gain. You might do this by employing a buy-and-hold strategy, in which you only acquire securities that you intend to hold for the foreseeable future. Fewer tax events can translate into a lower overall tax burden.

-

Think about holding your assets for longer than a year in order to avoid the higher tax rate associated with short-term capital gains.

-

Consider tax-loss harvesting, which entails selling assets at a loss to partially offset the gains you’ve realized elsewhere, thus reducing your total taxable income and, ultimately, the size of your tax bill.

-

Moving interest- and dividend-paying investments into an IRA, 401(k), HSA, 529 Savings Plan, or another tax-advantaged account can help defer or exempt you from some taxes.

If you could use some guidance creating a tax-efficient investment strategy, or would like to improve the tax efficiency of your existing one, don’t hesitate to connect with us at CAM Investor Solutions.

Source: IRS. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.