It’s been said that the stock market does not like surprises…

Inside-Out Investing: Part Two

How do people make decisions? There are scientists and psychologists that dedicate their entire career to studying this question. We are each unique in our thinking, processing, upbringing, values and emotions. Some decisions are perfectly okay to be made by gut feelings or emotions – the heart, while others should really be made through sound reasoning, research, logic, data – the brain. Which do you think we should use when making investment decisions – the heart or the brain? Which do you think most people actually use? It doesn’t have to be one or the other, but they should be used in the correct order.

In part one of our Inside-Out Investing blog, found here, we explore this concept of Inside-Out investing. The Inside-Out approach starts with your heart, aligning your investing approach with what matters most to you. Once you’ve taken the time to discover what that means for you, you can confidently build your unique investment plan that then uses your brain to choose your investments. No longer will your emotions dictate your investment strategy, but your plan that started with your heart.

Blog one helped you find what’s in your heart, now in blog two well use that to build your unique plan.

Map Your Plan

Below we will outline the process for linking your personal purpose and values to your life goals and investments. This process includes identifying your personal values, writing your why statement, and establishing financial goals and action steps. Feel free to grab pen and paper to write down your thoughts – use this blog as your guide.

Claim Your Value

Your investing why is an important starting place. Now let’s identify the values—the core qualities or commitments—that underlie the reasons why you want to invest.

For example, wealth is seldom a value. Instead, wealth is usually a means to attain a core value like security, freedom, or generosity. When thinking about your own values, go deep!

Use these examples above as your starting point, or feel free to think up your own. The key is to ask yourself what deep values have led you to the list of reasons why you want to invest.

Write your why statement

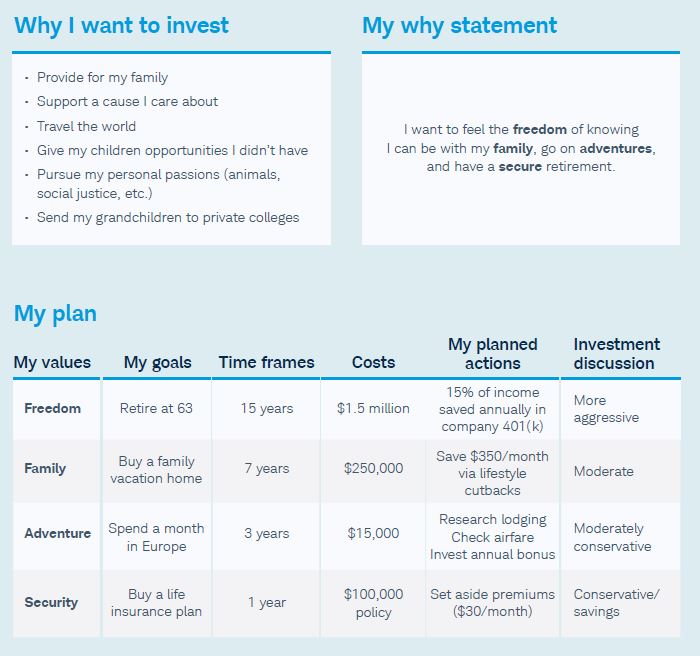

Now it’s time to write your why statement . Reflect on your core values and the reasons why you want to invest. And look at the sample plan to see an example of a why statement.

Decide what you want and when – Goals

Now that you’ve identified your deep motivations, you can set genuine financial goals and time frames. You’re most likely to act on goals that tie to your values and represent what’s most important to you in life.

Aim to create goals that are clear and precise, actionable (even just a little actionable), and exciting to you. Don’t stress about getting them exactly right. This plan is meant to be fluid and flexible, and it can change over time. For now, try to simplify. Then refine and adjust as you go along.

Add costs and action steps

Now make your goals even more concrete. What might they cost? What actions do they warrant? How will you use investing and investments to help achieve them?

What actions can you take on your goals now?

- Do you have research to do?

- Do you need to set aside a specific dollar amount in your savings account each month?

- What is your role in making this goal happen?

- Committing to action steps will help you stay engaged with your plan – along with helping you feel a sense of satisfaction as you make progress toward your goals.

Discuss your investment approach

The final step in your inside-out investing plan is to make the investments themselves. To settle on an investing approach that resonates with you, take your inside-out investing plan to your next meeting with your advisor and talk about the investing goals you’ve identified. Talk about your why, your values, and your goals. Talk about your risk tolerance. And together with your advisor, agree on an approach to investing that matches up with your life.

Sample Inside-Out Plan

This sample investing plan will give you a good idea of what a completed one-page investing plan looks like. Your personal plan will contain the same elements but be customized with your personal information. Use this sample plan as inspiration to help find the answers that feel right for your life and your goals. The result will be a simple, one-page plan that aligns your investing approach with what you care about most.

Invest in what you care about most

Making a plan and setting your course is just the start of your investing journey. Now you’ll need to stay the course and help yourself succeed. A financial advisor is a crucial element in establishing and maintaining your investing plan. But there are things you can know—and do—on your own to increase the probability of reaching your goals over time.

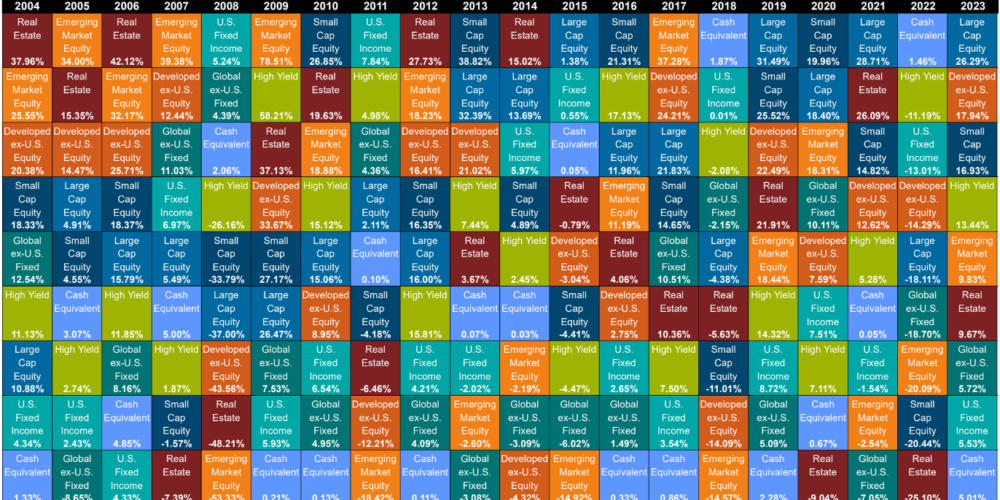

Stick with it – invest for the long-term and don’t let volatility change your plan. Plan for problems – have an emergency fund set aside for those unexpected expenses. Control what you can control – diversify your portfolio, minimize costs, automate decisions. And stay in touch – meet regularly with an advisor to review your progress.

This exercise is intended to help you see how investing can be a meaningful part of your life and help you make progress toward what you care about most. It’s about connecting the heart with the mind to achieve your goals rationally and successfully. By following these steps and working with an advisor, you can start linking your investments with your life. We’d love to talk to you about your plan or help you walk through this exercise with us.

Source: Schwab Asset Management. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.