Weight Watchers, the iconic American health and wellness giant, filed for…

New Market Highs – Now what?

Markets have reached new all time highs – again! It’s very exciting and good for investors. Now what? Should you invest more? Invest in specific companies or sectors or countries? Or maybe you’re tempted to “get out while you’re ahead”. When you put it in these terms, it feels a lot like gambling. But if you’re interested in investing for the long-term, for bigger goals, for the reward of being patient – there are a few investor pitfalls to be wary of.

Be Wary of the Past

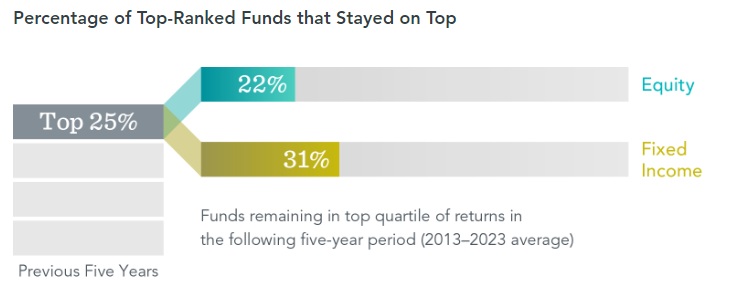

Especially in times like now, with markets at all time new highs – you might be tempted to select investments based on past returns. Why shouldn’t top-ranked funds continue delivering the best performance? Just like an Olympic gold medalist can only run so fast, so far – eventually they need to rest, come down from their highs. Should investment funds be expected to indefinitely outperform? Research shows that most funds ranked in the top 25% based on five-year returns didn’t remain in the top 25% in the next five years. In fact, only about one in five equity funds stayed in the top-performing group, and only about a third of fixed income funds did. The lesson? A fund’s past performance offers limited insight into its future returns.

Headlines are Tempting & Distracting

Have you been in a social gathering lately where people are talking about what stocks are at all time highs? It’s hard NOT to talk about a company that has had a return of over 200% in the last 12 months, like NVIDIA. Many people may become enamored with popular stocks based on recent performance or media attention—and overconcentrate their portfolio holdings in these companies. Using the gambling metaphor, it’s easy to gravitate to the “lucky” table – but someone else’s luck doesn’t ensure you’ll experience the same luck.

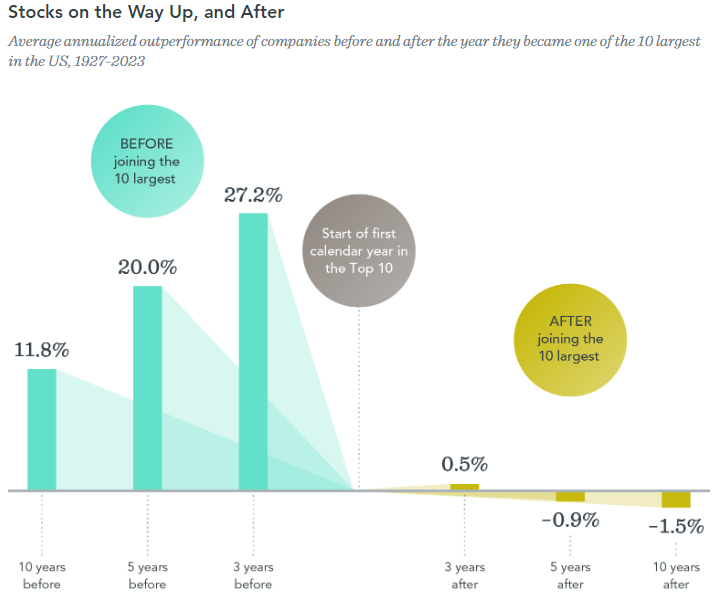

Have you heard of the Magnificent 7 (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla) – the large US technology companies driving the high returns in 2023 and 2024 so far? The chart below shows that many fast-growing stocks have stopped outperforming after becoming one of the 10 largest stocks in the US. On average, companies that outperformed the market on the way up failed to outperform in the years after making the Top 10 list.

The lesson? Don’t put all your eggs in one basket. Rather than loading up on ONLY a handful of stocks that have dominated the market, you can own many stocks through mutual funds or ETFs, including the top performers. Diversifying across industries and global markets can help reduce overall risk and position investors to potentially capture the returns of future top-performing companies.

Can you guess correctly 3 times?

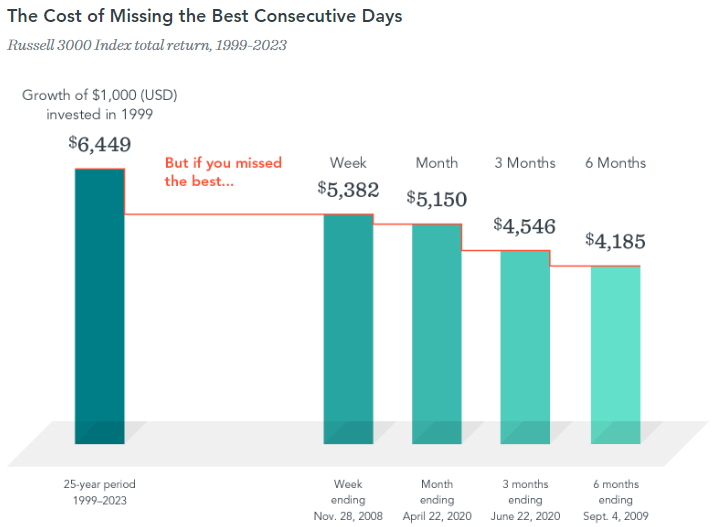

The opposite may happen when markets are trending down. Instead of chasing the “hot stocks”, some investors may be tempted to cash out of the stock market to avoid a predicted downturn. But accurately forecasting the market’s direction to time when to buy AND sell AND buy again is a guessing game. You have to be correct 3 times for your market timing to work. Missing only a brief period of strong market performance can drastically affect your lifetime wealth.

For example, the chart below shows a hypothetical investment in the Russell 3000 Index, a broad US stock market benchmark. Over the entire 25-year period ending December 31, 2023, a $1,000 investment in 1999 turned into $6,449. But what if you pulled your cash out at the wrong time? Missing the best week, month, three months, or six months would have significantly reduced the growth of your investment.

Markets will go up and down. There will be periods where your portfolio loses money. But rather than trying to predict when stocks will rise and fall, you can hold a globally diversified portfolio. By staying invested you can be better positioned to capture returns whenever and wherever they occur.

Working with an Advisor

Being aware of these investor pitfalls and avoiding them can improve the odds of reaching your long-term investment goals. But, as a do-it-yourself investor, you’ll have to manage the challenge alone. A qualified financial advisor can offer deeper expertise and insights that lead to better financial habits.

But the potential benefits go beyond just helping you avoid a bad decision. An advisor can design a diversified, research-backed investment strategy based on your long-term goals and comfort level with risk. Equally important, you can look to a seasoned professional for guidance through different markets. By walking with you on the journey, an advisor can encourage the discipline essential to building wealth over time.

At CAM we’ve worked with clients through many up and down markets over the past 20 years. We are experienced and prepared to help you weather the markets ahead.

Source Disclosure

Source: Dimensional Fund Advisors LP

“Percentage of Top-Ranked Funds that Stayed on Top”: Full disclosure details can be found on Dimensional’s website here.

“The Cost of Missing the Best Consecutive Days”:

Best performance dates represent end of period (November 28, 2008, for best week; April 22, 2020, for best month; June 22, 2020, for best three months; and September 4, 2009, for best six months). The missed best consecutive days examples assume that the hypothetical portfolio fully divested its holdings at the end of the day before the missed best consecutive days, held cash for the missed best consecutive days, and reinvested the entire portfolio in the Russell 3000 Index at the end of the missed best consecutive days.

Data presented in the growth of $1,000 exhibit is hypothetical and assumes reinvestment of income and no transaction costs or taxes. The data is for illustrative purposes only and is not indicative of any investment. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

“Stocks on the Way Up, and After”

Includes all US common stocks excluding REITs. Largest stocks are identified at the end of each calendar year by sorting eligible US stocks on market capitalization. The market is represented by the Fama/French Total US Market Research Index. The 10 largest companies are identified by market capitalization. Returns after joining the 10 largest are measured as of the start of the first calendar year after a stock joins the Top 10.

Annualized excess return is the difference in annualized compound returns between the stock and the market over the three-, five-, and 10-year periods, before and after each stock’s initial year-end classification in the Top 10. Three-, five-, and 10-year annualized returns are computed for companies with return data available for the entire three-, five-, and 10-year periods, respectively. The number of firms included in measuring excess returns prior (subsequent) to becoming a Top 10 stock consists of 44 (56) for the three-year period, 43 (54) for the five-year period, and 35 (49) for the 10-year period

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.