It’s been said that the stock market does not like surprises…

Reviewing your Financial health in your 30s and 40s

It seems like not matter what season of life we’re in, it’s a busy one. But one could argue that your 30s and 40s could be the busiest of them all. Whether you’re days are filled with family, work, friends, education, events, hobbies, etc – there never seems enough time in the day to get it all done. This doesn’t leave a lot of time to take care of the less “fun” adult tasks, like planning to sure up your financial health and risks.

Today we’re exploring some foundational financial planning concerns that individuals in their 30s and 40s might encounter (hey that’s pretty much the life stage we are in here at CAM!). Whether you’re just starting to build your financial foundation or well into the journey, it’s essential to be aware of potential risks to make informed decisions.

“Oh No” Funds

One risk that individuals in their 30s and 40s often overlook is the lack of a solid “oh no” or emergency fund. Unexpected events such as medical emergencies, job loss, or unforeseen repairs can throw you off track if you’re unprepared. Emergencies could be things like tires on a vehicle (if not planned out in advance), an appliance suddenly breaking in your home, or anything else unexpected. Also know what your insurance deductibles are and if you have enough cash to cover them. If you have to file a claim to your homeowners policy, it will cost you the deductible. The same goes for health insurance deductibles if you are sick or hospitalized. Aim to have at least three to six months’ worth of living expenses saved in an easily accessible account. We usually recommend a liquid high yield savings for these funds. This safety net will help you weather unexpected storms without derailing your long-term financial goals.

Slow-start on Retirement Savings

It can be hard to see the point of saving for when you’re 80 or 90, right now. You’ve got over 50 years to save and immediate expenses like a mortgage or daycare may seem more pressing. Why should you contribute to retirement accounts now? Many people in their 30s and 40s face the challenge of balancing immediate financial needs with long-term retirement planning. It can be tempting to prioritize short-term goals like purchasing a home or raising a family over saving for retirement. However, neglecting retirement savings can have far-reaching consequences.

Start by contributing to employer-sponsored retirement plans, such as 401(k)s. Taking full advantage of any employer-matching contributions is like “free money”. If you don’t have a work sponsored retirement plan, you can either open your own IRA/Roth IRA or an investment account, depending on your goals and income. Women especially need to prioritize this. We tend to live longer and often spend more time out of the workforce caretaking for family. This is admirable but can put us behind in our savings goals. So start as early as you can, no matter the amount. Once you start saving you might be wondering; what do I even invest this in?? We have a lot more information on our site that discusses this, but be sure to pick some funds that give you a well diversified portfolio.

Debt Avalanche

Mounting debt is another potential risk for your age group. Juggling student loans, credit card debt, car loans, and mortgages can leave you feeling overwhelmed and financially vulnerable. Prioritize paying off high-interest debt first. This is known as the debt avalanche method, where you focus on eliminating the debt with the highest interest rate while maintaining minimum payments on other debts. This approach saves you money in interest payments and accelerates your journey toward becoming debt-free. Using strategies like the 50-20-30 budget plan and managing expenses in tools like Mint or Simplifi by Quicken can help you keep track of your expenses and savings.

Too Much of One Thing

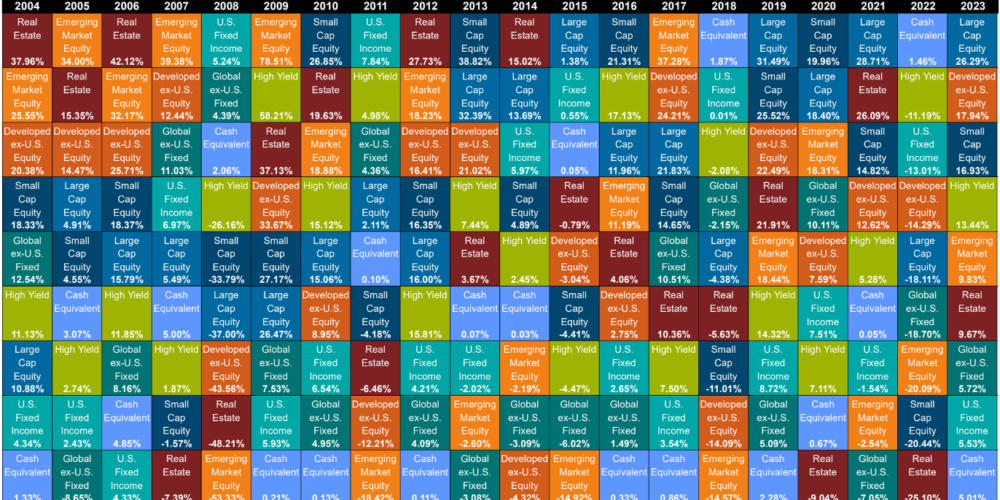

As you move towards financial security, investing plays a vital role. However, growing your wealth through investing involves an inherent level of risk. A common mistake in this age bracket is overexposure to market volatility. Have you received stock from your employer as a bonus in the form of stock options, RSU, or ESPP shares? These are great benefits, but if you hold too many shares of your employer’s stock, you may be over invested. Remember Enron? Or perhaps you got caught up in the “meme investing” craze. Avoid relying too heavily on a single investment or sector, diversify your portfolio to minimize risk.

I have worked with investors in the past who attempted to find rapid growth in their investments by using a couple of aggressive stocks and very specific sector funds to invest in. They lost most of their investment and often were afraid to take any risk for years to come, missing out on consistent returns. This can have a long term detrimental affect on your retirement goals. Investing is essential, but doing it the right way can make all the difference for your success (not to mention sanity too!). Make sure you check out our other blogs on investing and risk management for more information about this.

Protect your Family

Life is unpredictable, and securing adequate insurance coverage is crucial. Having appropriate health, life, disability, and property insurance ensures you’re shielded from potential financial catastrophes caused by illness, accidents, or unforeseen events. Review your insurance policies periodically to make sure they still align with your needs. I’ve said this before and I’ll say it again; while the generosity of the community is great for things like GoFundMe, this should not be your primary source of help. As a CERTIFIED FINANCIAL PLANNER™ one of the first things I look at for families with children is their insurance coverage and if they have enough should something catastrophic happen.

Also, try to seek objective advice in this category and be aware when an agent is making commissions on the policies they want to sell you. A general rule of thumb for a life insurance policy should be about 10-12 times your salary, but every circumstance is different so be sure to work with your planner on what fits your family’s needs. It should also be mentioned that having a will in place and documents to name guardians for your children are absolutely essential.

While individuals in their 30s and 40s face unique financial risks, armed with knowledge and foresight, you can safeguard your financial well-being. Prioritizing emergency funds, retirement savings, debt management, diversified investments, and proper insurance coverage are key considerations on this journey. Remember, seeking professional advice from a CFP® can help you make informed decisions and navigate the turbulent waters of personal finance. Stay proactive, stay informed, and set yourself up for a financially secure future!

Good luck, and until next time, happy financial planning!

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.