We’ve said before that the most dangerous four words in investing…

What’s Your Glide Path in Retirement?

The classic image of retirement investing is that of a retiree putting 100% of his or her assets into bonds and clipping coupons from those bonds for income payments. That image goes back to when bondholders had to physically cut coupons off bond documents and submit them to the issuer to receive the interest that a bond paid.

Just as the days of clipping coupons are long gone, so is the idea that bonds alone constitute a complete retirement investing strategy. Asset allocation, the process of dividing up your portfolio among stocks, bonds, cash, and possibly other types of investments, accounts for most of the ups and downs of a portfolio’s returns. That’s just as true for your retirement portfolio as it was during the years you’ve spent trying to build those assets. That means the need for proper asset allocation doesn’t stop when you retire. After all, it’s possible you could spend roughly as long withdrawing from your nest egg as you’ve spent creating it.

Asset allocation alone does not guarantee a profit or ensure against a loss, but it can help you manage the level and types of risk you take with your investments based on your specific needs.

In retirement, your asset allocation may need some alterations to ensure that it:

- Provides ongoing income needed to pay expenses

- Minimizes volatility to assure both reliable current income and the ability to provide income in the future

- Maximizes the likelihood that your portfolio will last as long as you need it to

- Keeps pace with inflation in order to maintain purchasing power over time

Striking the right balance over time between predictable income, capital preservation, portfolio volatility, portfolio longevity, and the need to maintain purchasing power is the role of a glide path.

What is a glide path?

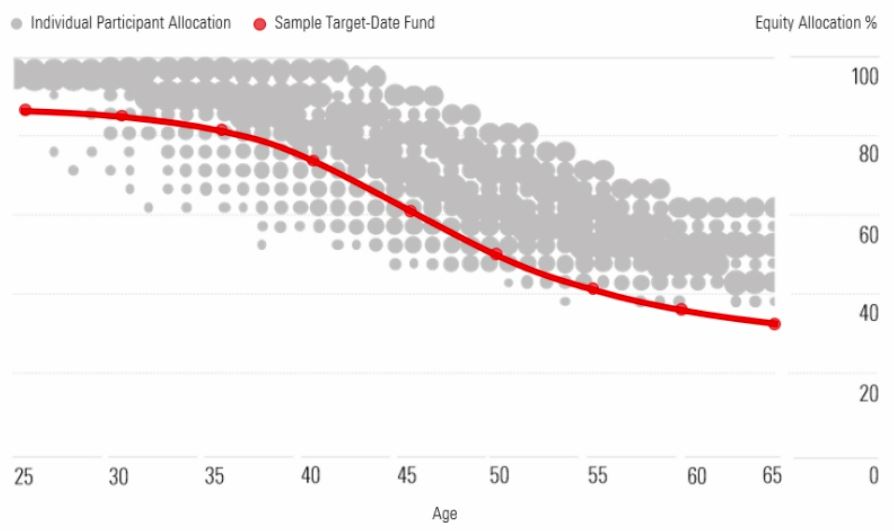

An equity glide path refers to the process of gradually, methodically adjusting a portfolio over time, generally by reducing the percentage devoted to equities in order to make it more conservative as the portfolio draws closer to a given date. In a way, the glide path resembles that of an airplane as it heads for a landing; your portfolio’s glide path attempts to ensure that you reach your goal without stopping short before the end of the runway. As you were saving for retirement, did you become more conservative with your investments as you’ve gotten closer to retirement? If so, you’ve had a glide path without even realizing it.

A glide path can apply to any investment portfolio that is managed with a time frame in mind. It’s easy to see why a glide path might be important in retirement. As you age and continue to tap your retirement assets, your financial and psychological ability to tolerate risk may be reduced over time; that has implications for the role of equities in your portfolio.

A glide path may apply not only to shifting percentages among the three major asset classes: stock, bonds, and cash, but also to specific sectors. For example, a glide path might gradually reduce the percentage of the stock portfolio that is devoted to riskier types of stocks, such as small-cap stocks or emerging-market stocks, and concentrate on larger, well-established domestic companies in an attempt to reduce the portfolio’s volatility. It might even eventually eliminate certain asset classes entirely in the portfolio’s later years.

Not indicative of actual plan participants and data.

Examples of asset allocation and glide path strategies

Your individual strategy will need to be tailored to your own situation and needs, but the following represent some hypothetical examples of various ways to manage asset allocation in retirement. Bear in mind that all investing involves risk, including the possible loss of principal, and there can be no guarantee that any investing strategy will be successful.

- Static asset allocation: In some cases, a glide path may be essentially flat. An initial asset allocation is set, then rebalanced periodically to maintain the relative weightings of various types of investments from year to year.

- Tactical asset allocation: A portfolio that shifts its asset allocation based on projected market conditions may have no firm glide path at all. In some cases, a portfolio manager may combine approaches by establishing a core asset allocation or glide path while using tactical asset allocation for a portion of the portfolio.

- Fixed decreases over time in the percentage of equity investments: This approach gradually reduces the investment in equities by a given percentage at regular intervals. For example, a hypothetical retiree might reduce the equity allotment by 2% each year, or 5% every five years.

- Accelerating decreases in the equity portion during the later retirement years: This approach not only would make a portfolio more conservative as the retiree ages; it would gradually speed up the process of doing so. The older the retiree, the more rapidly the equity portion is reduced.

EXAMPLE: When John retires, he initially decides to reduce the equities portion of his portfolio by 2% every five years. After he reaches a certain age, he accelerates the process of making his portfolio more conservative by increasing the percentages he shifts out of equities and into other asset classes – cutting his equity allocation by 4% every other year, and to go even further by cutting 7% from his equity allocation each year once he’s been retired for 20 years. - Slowing the process of reducing equity allocations in later retirement years: This is the opposite of the above strategy. Instead of gradually increasing the rate at which equities are reduced, this strategy instead continues to reduce equity investments, but at a slower pace.

EXAMPLE: When Jane retires at age 62, she begins to reduce her equity allocation by 6% every five years. After 15 years, she is concerned that if she continues at that pace, her portfolio eventually might not be able to maintain her standard of living in later years. She continues to reduce her equity investments, but now cuts it by only 4% every five years, eventually bringing down the percentage shifted out of equities to 1% every other year.

No one glide path is appropriate for everyone. An asset allocation strategy that might be highly suitable for someone with a ten-year time frame might have a much lower probability of success over a longer period. And even if a given glide path produces higher long-term returns, it may not be sustainable if the portfolio is too volatile for your individual comfort level, or cannot produce an income that’s reliable enough from year to year to cover needed expenses. Any projected glide path should take into account your ability to implement that strategy and stick to it over the long term.

Have questions about what’s the right approach for you and what your unique glide path should be? We’re happy to provide a second opinion via a free consultation. Setting up a meeting with us is easy through our online booking tool. We want to see you enjoy retirement unburdened with concerns of longevity.

Source: Morningstar. M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.