We’ve said before that the most dangerous four words in investing…

Why not just buy the S&P 500 Index?

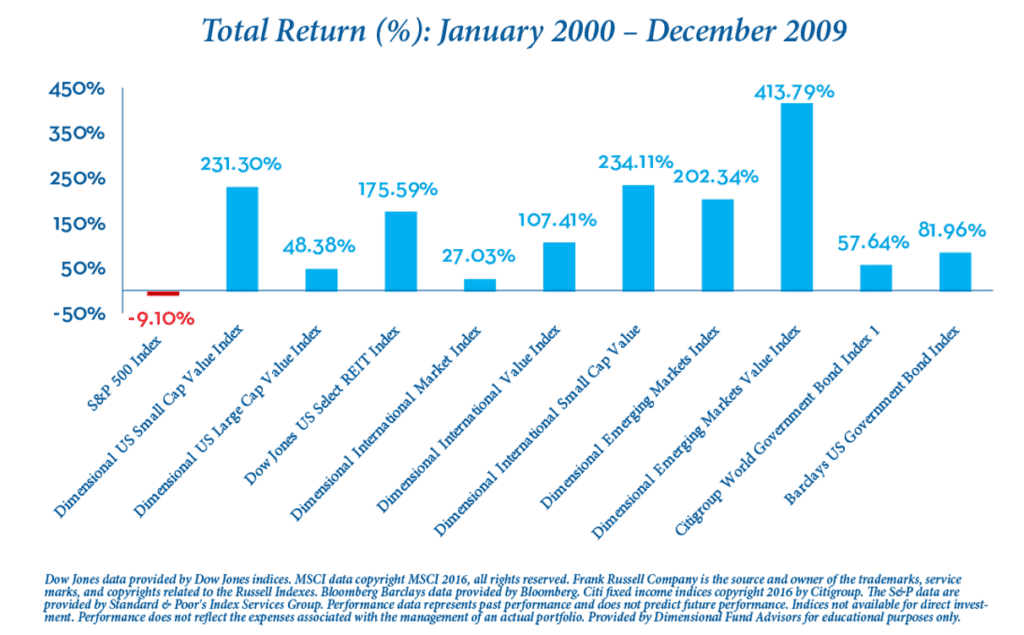

That question (and many related ones) is being thrown around a lot these days, both by investors and in the media. The reason it’s being asked is, of course, because the S&P 500 has led most other major market indices over the past decade or so. This, in turn, begs the question: “If big, blue chip U.S. stocks outperform the rest of the market, then why diversify at all?”

Same story, 30 years ago

It seems like just yesterday we were addressing this same topic – but in fact it was about 30 years ago. The large cap stocks of the S&P 500 dominated the market for years in the mid-to-late 1990s, with small cap stocks, value stocks, and most other asset classes trailing far behind.

By 2010, however, no one was suggesting that “just buying the S&P 500” was a sound investment strategy. Investors who bought an S&P 500 index fund in 2000 experienced a negative total return for a full decade. At the same time, the small cap value, REIT and international asset classes all outperformed the S&P 500, many of them significantly.

To get equity rates of return, investors have to be invested in equities and have to accept the increased volatility that comes with stocks as compared to bonds or cash. This is called “market risk” and there’s no avoiding it if you are a stock investor. To reduce the concentration of market risk, we invest across asset classes and markets for our clients.

The risk of acting on forecasts

Often when some company or asset class is doing very well, it attracts attention. Whether this attention is being broadcasted through proper news channels, online, or through social media – everything is pointing back to the “one hot thing” of the day. And usually what pairs nicely with a hot investment is somebody making future predictions (forecasting).

This Wall Street Journal article’s title says it all: “Jamie Dimon and Ray Dalio Warned of an Economic Disaster That Never Came. What now?”

“What now?” is a very good question for investors who heeded their advice and bailed out of the market. Despite the legendary status of Messrs. Dimon and Dalio on Wall Street, their hot take on a looming economic crisis turned out to be colder than a New York winter:

In mid-2022, JP Morgan Chief Executive Jamie Dimon warned that a “hurricane” was about to hit the U.S. economy.

It could be “a minor one or superstorm Sandy,” Dimon said at a financial conference in New York. “You’d better brace yourself.”

Last year, Bridgewater Associates founder Ray Dalio predicted a “debt crisis” after earlier anticipating a “perfect storm” of economic pain.

High-profile investors and economists including DoubleLine’s Jeffrey Gundlach and Rosenberg Research’s David Rosenberg were just as fearful, with Gundlach last March saying a recession would come “in a few months.” Early last year, economists predicted a 61% chance of recession in 2023.

The experts were way off. They underestimated the impact of government stimulus and the resilience of consumers and businesses. And they were too skeptical of the Federal Reserve’s ability to push inflation lower without sparking a recession.

“I was bearish on the economy,” Dalio said in an interview. “I got it wrong.”

Said Dimon, also in an interview: “I would have thought some of the fiscal stimulus would have worn off by now.”

Mea culpas are insufficient comfort to those who followed their advice. Stocks have soared the past six months, defying the doom-and-gloom forecasts that permeated the financial media in 2023. As is always the case with investors who try to time the market and guess wrong, figuring out what to do when stocks roar past you is the worst part of the dilemma.

Why it’s hard to forecast

There’s also another interesting line in the article above, a point I raise frequently in this message and often in client discussion:

“They underestimated…the resilience of consumers and businesses.”

This is a common mistake market pundits make when assessing the current economic climate and projecting it into the future. Analysts rely on their assumptions about tangible metrics to make their economic forecasts. Inflation rates, GDP, monetary policy, etc.

But the human spirit is distinctly intangible and therefore can’t be forecast. Analysts can’t know it or project it, yet it’s a massive driver of the global economy.

Consider the state of Germany and Japan at the end of World War II. Both countries were utterly devastated, physically and psychologically. Yet, within two decades, West Germany and Japan were two of the most thriving economies in the world.

Human ingenuity in free economies will always find a way forward. Crises are inevitable – but they always come and go, and the ensuing recoveries typically last a lot longer than the crises do.

Evidence-based investing, then, is about embracing the belief that markets work, because people work. We accept the periodic downturns as part of the deal and enjoy the long periods of economic flourishing as the reward for our emotional discipline.

What about the mega stocks?

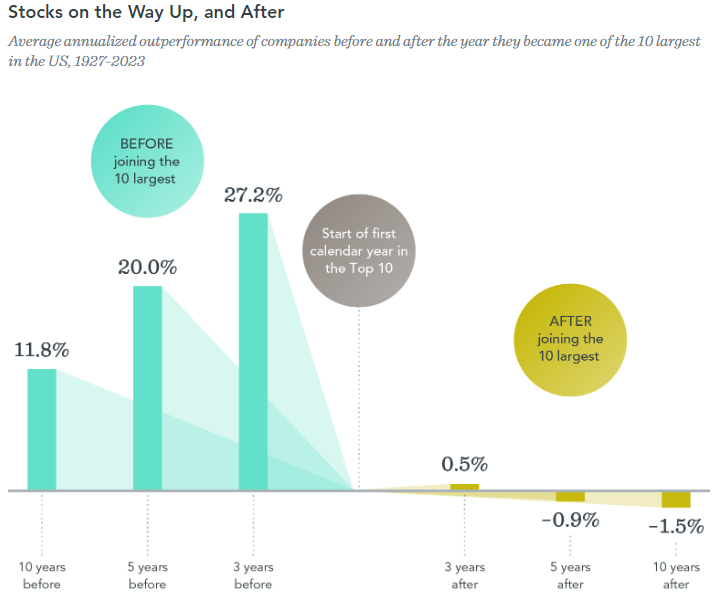

Maybe you’re not tempted by the S&P 500, but what about NVIDIA, Apple or Amazon? Why not just hold them and forget the rest? As companies grow to become some of the largest in the US stock market, their returns can be impressive. As you can see in our previous blog, New Market Highs – Now what?, it’s hard for these top stocks to maintain their pace of growth long-term. This doesn’t necessarily mean their performance will be negative, it may just be less than what it has been in previous periods. Think twice about chasing the biggest stocks.

- From 1927 to 2023, the average annualized return for these stocks over the three years prior to joining the Top 10 was more than 25% higher than the market.

- Five years after joining the Top 10, these stocks were, on average, underperforming the market— a stark turnaround from before. The gap was even wider 10 years out.

Expectations about a firm’s prospects are reflected in its current stock price. Positive news might push prices higher, but those changes are not predictable.

So if you’re being enticed by the media or a friends investment luck, stop and take a breather. What is your investment strategy? How do you believe markets work? Ask yourself if you or those you listen to have the knowledge to forecast what’s to come.

At CAM we do not have a crystal ball. We make no predictions and we don’t follow the advice those who do. We bring a disciplined process to our clients. What does that mean for you? We help you have a smoother, less volatile investment experience, while staying focused on what matters most to you.

Source Disclosure

Wall Street Journal

Dimensional Fund Advisors LP

“Stocks on the Way Up, and After”

Includes all US common stocks excluding REITs. Largest stocks are identified at the end of each calendar year by sorting eligible US stocks on market capitalization. The market is represented by the Fama/French Total US Market Research Index. The 10 largest companies are identified by market capitalization. Returns after joining the 10 largest are measured as of the start of the first calendar year after a stock joins the Top 10.

Annualized excess return is the difference in annualized compound returns between the stock and the market over the three-, five-, and 10-year periods, before and after each stock’s initial year-end classification in the Top 10. Three-, five-, and 10-year annualized returns are computed for companies with return data available for the entire three-, five-, and 10-year periods, respectively. The number of firms included in measuring excess returns prior (subsequent) to becoming a Top 10 stock consists of 44 (56) for the three-year period, 43 (54) for the five-year period, and 35 (49) for the 10-year period

CAM Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.