Tax advantaged investment strategies are becoming a priority for high-net-worth investors…

Your Parent(s) Are Moving In; Now What?

The decision to have your parent(s) move in with you is a significant life event that requires careful planning and open communication. Whether the move is motivated by financial reasons, healthcare needs, or simply a desire to be closer, there are several considerations to keep in mind when parents move in. Keep reading to learn more about the conversations and thought processes that should take place before making this big life decision.

Reasons Parents Live with Adult Children

- Financial for Either Party

Whether it’s you or your parents who are financially strained, cohabitating can offer a practical solution. However, it’s essential to discuss how bills will be split and whether any renovations are needed for their comfort and safety. - A Sense of Community

Loneliness can take a toll on mental health. Living together can provide a robust emotional support system, especially useful for parents who are divorced or widowed. - Support for Adult Kids and Their Children

Grandparents can offer a wealth of experience in childcare and household management. This can be a win-win situation, but it’s crucial to set boundaries to avoid conflicts. - Health Reasons

If your parent(s) require daily medical care or assistance with activities, living together can make logistical sense. However, this also means you’ll need to discuss the level of care required. - Cultural Reasons

In some cultures, it’s customary for multiple generations to live under one roof. If this is the case, you may find that there are established norms and expectations that can make the transition smoother.

First things first

Do you want this to happen?

This is the foundational question. Are you emotionally and mentally prepared for the lifestyle changes that come with living with an aging parent? Keep reading to review some of the discussions and questions to help plan your decision.

Spousal and Family Conversations

Your spouse and children also have a stake in this decision. Discuss how this change will affect your nuclear family’s dynamics, including privacy and space. Everyone under your current roof should be able to share in the discussion about what they need and want.

Financial Impact

Beyond splitting bills, consider the long-term financial implications. Will you need to modify your home to accommodate them? What about potential increases in utility bills or food? Be sure both parties are understanding and in agreement before committing to the new arrangement.

Setting Boundaries with Parents

This is a delicate but necessary conversation. Discuss everything from quiet hours to how often they’ll help with childcare or household chores. Imagine your parents getting frustrated with you expecting them to watch the kids all the time or you irritated that they expect to go on every family outing or vacation with you. Communication is key here!

Roommate Contract

Ok this might be a bit extreme (anyone remember Sheldon’s contract in The Big Bang Theory??). However, a formal agreement can help prevent misunderstandings and set a clear course for conflict resolution.

Timeframe

Is this a stop-gap measure or a permanent arrangement? Knowing the duration can help in setting appropriate boundaries and financial plans. If this is longer term, the next critical discussion points are going to be about long-term care of aging parents.

Moving in for healthcare reasons

Timing the Decision

The state of your parent’s health will largely dictate when to make this move. Is it in the early stages of an illness, or is end-of-life care imminent? The severity and type of health condition will significantly influence the timing. I will say, no matter the current health, a lot of these decisions get harder for both parties as parents get older. It can also be a good idea to consult with healthcare providers for a more informed decision.

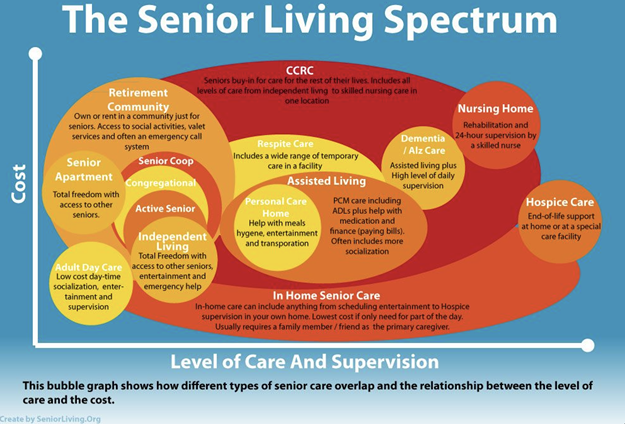

Level of Care Needed

From medication management to full-time care, the level of assistance required can vary widely. Make sure you’re up to the task, both emotionally and physically. And of course these needs can change over time, so consider planning ahead and sourcing additional help and resources.

Work Commitments

If you or your spouse need to quit your jobs to provide care, consider the financial and career implications carefully for yourselves. This is the time to review your financial plan if you need to consider stepping away from your job.

Financial Burden

Healthcare is expensive. From medications to potential home modifications like ramps or grab bars, these costs can add up quickly. Not to mention hiring in-home help to care for an aging or ill parent can be costly. Create a plan for how these costs will be covered.

Self-Care for Caregivers

Caregiver burnout is real. 40-70% of caregivers experience depression and 23% of family caregivers report caregiving has negatively affected their physical health. Make sure to allocate time for yourself and consider respite care options.

Are you ready?

Inviting your parent(s) to live with you is a multifaceted decision that requires thoughtful planning and open, honest communication. By addressing these key points, you’re laying the groundwork for a harmonious living arrangement that respects the needs and boundaries of all involved. I strongly suggest reaching out to a fee-only advisor to assess the financial impact of caregiving once you’ve given these questions a thorough review.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.