Discover the power of strategic financial planning. Invest with purpose, avoid speculation, and achieve your financial goals with tailored strategies.

What I Wish People Knew About Inheriting an IRA

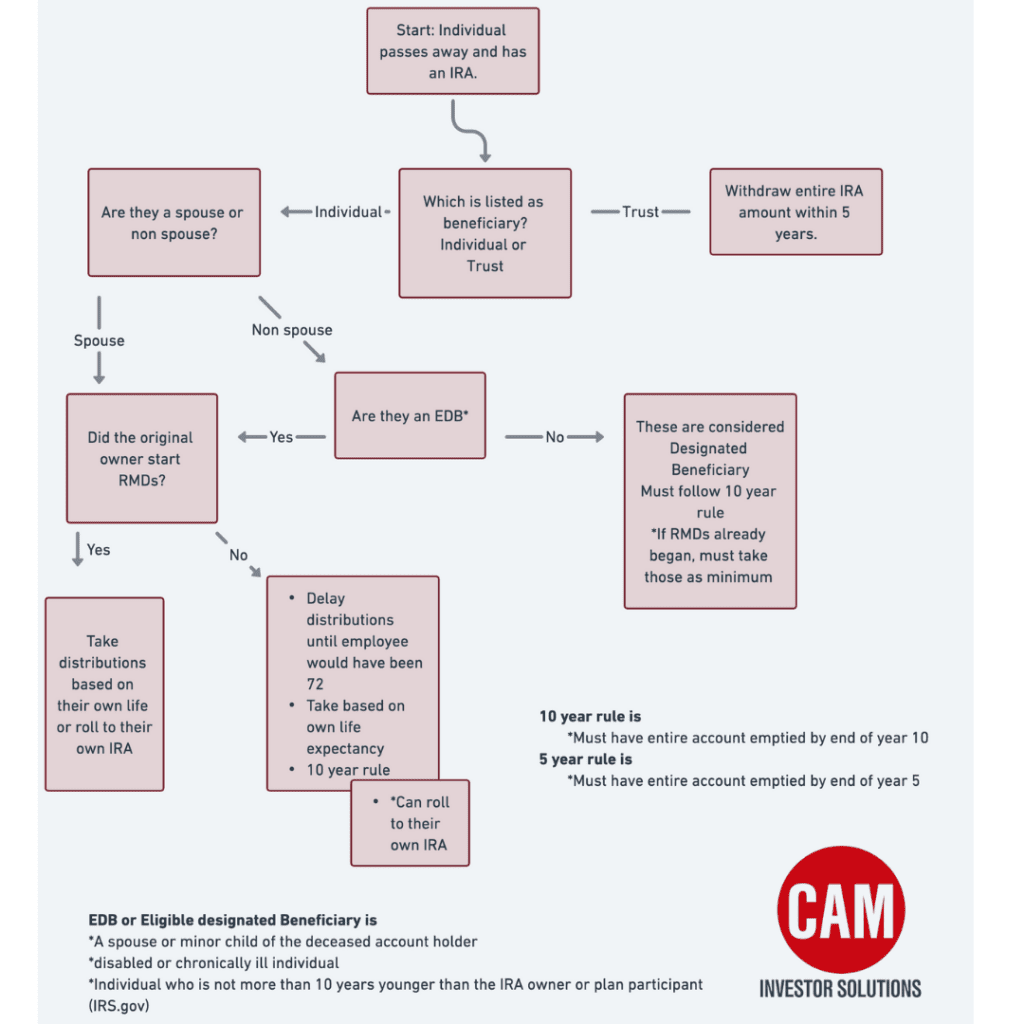

Inheriting an Individual Retirement Account (IRA) can be a financial boon, but it also comes with its own set of rules and considerations. While many people are aware of the benefits of having an IRA, not everyone is familiar with the intricacies of receiving an inherited IRA. Here’s what I wish more people knew about this process:

1. It’s Not Just About Receiving Money

When you inherit an IRA, it’s not as simple as just receiving a lump sum of money. There are decisions to be made, and the choices you make can have significant tax implications.

2. Spouses Have More Flexibility

If the beneficiary of the IRA is a spouse, they have a unique set of options. They can:

- Treat the IRA as Their Own: This means they can make contributions, take distributions, and essentially manage the IRA based on their own age and requirements.

- Roll Over into an Inherited IRA: If they choose not to treat it as their own, they can roll it over into an inherited IRA. However, they will have to take Required Minimum Distributions (RMDs) based on their own life expectancy.

3. Non-Spouses Have Different Rules

For non-spouse beneficiaries, the rules are a bit more complex: If you are familiar with the term ‘stretch IRA’ this was an option that allowed a beneficiary to take out distributions over their lifetime which lowered tax implications and more time for the IRA to grow tax-deferred. In 2020 the SECURE Act changed this and a ‘stretch’ is no longer available.

Now, we need to determine if the beneficiary is an Eligible Designated Beneficiary (EDB). If they are a minor child of the deceased account holder, disabled or chronically ill, or an individual who is NOT more than 10 years younger than the IRA owner, they would follow similar rules to the spouse. I would suggest a review from a qualified tax professional or planner to confirm what steps to take as these situations can be a bit more complex.

If they are not an EDB, they would be considered a Designated Beneficiary. Examples of this could be an adult child, friend, family member NOT more than 10 years younger than the deceased. In this case, the beneficiary needs to follow the 10 year rule. This means the IRA needs to be emptied by year 10 following the original account owners death. It is especially important to confirm with your advisor about this. If the account owner was already taking the required distributions, the beneficiary may need to take a minimum each year even though they have 10 years to empty the account.

4. Tax Implications Are Crucial

One of the most significant aspects of inheriting an IRA is understanding the impact to your taxes. You could face substantial tax bills depending on how and when you withdraw from the inherited IRA. Imagine if you inherit $1 Million dollars in an IRA as a non-spouse. If you took the distribution all at once you could easily lose half in taxes. Even taking the distributions over 10 years could add more than 100k to your regular income which could change your tax bracket and eligibility for things like Roth IRA contributions, and various tax credits. It’s essential to consult with a financial advisor or tax professional to understand the best strategy for your situation and maximize the inheritance.

Inheriting an IRA is more than just a financial windfall; it’s a responsibility. By understanding the rules, considering the tax implications, and seeking professional advice, you can make the most of your inherited IRA and ensure that it serves your financial needs in the best possible way.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.