Looking back at the market or stock "winners" makes it seem easy to predict the future winners. But how easy is it really?

Is the S&P 500 enough?

“Why not just invest everything in an S&P 500 index fund?”

This is a question we hear like clockwork whenever that benchmark index leads the market for an extended period of time. Right now is one of those times with the stock rally that began last fall.

Admittedly, it can be frustrating for diversified investors to see the well-known S&P leading the market. If we’re not getting any upside from diversifying into other equity asset classes, then why diversify at all?

Why diversification matters

Even though the S&P 500 is considered a broad index, it really is comprised of just one asset class – large cap U.S. stocks. And just like any other asset class, the large stocks comprising the S&P 500 can experience very long periods of time in which they see no gain at all – or even a loss.

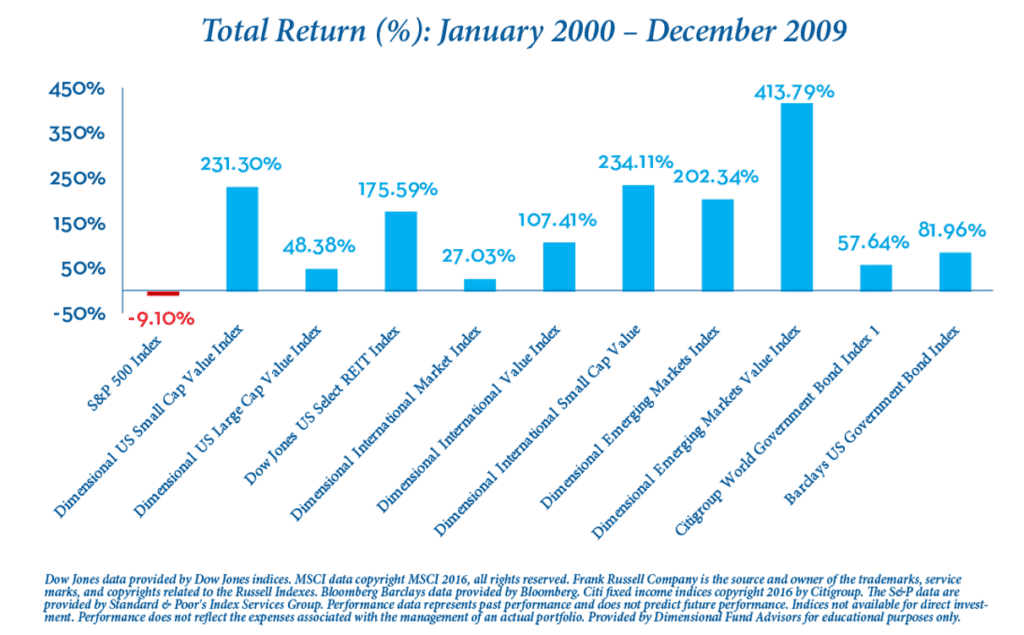

We don’t have to go very far back in time to see an example. The period from 2000 to 2009 is often referred to as the “lost decade for stocks,” a ten-year time span in which the S&P 500 actually experienced a total return of -9.10%. Yet while it was indeed a lost decade for the S&P, it was hardly a lost decade for many other asset classes.

During that same decade, small value stocks, REIT stocks and emerging markets stocks (among others) all posted total returns well into the triple-digits:

At its core, diversification is about risk reduction. By constructing a portfolio comprised of a wide variety of asset classes and investment styles, we are seeking to significantly reduce the considerable risk that comes from being concentrated in just one corner of the market. As we saw in the graph above, that risk isn’t just limited to more volatile asset classes, and it isn’t just a short-term risk.

Eat your veggies and diversify

There’s no getting around the reality that diversification is essentially an “eat your veggies” approach to investing. Some of the time, it may seem a lot less fun compared to investors gorging on the sugar rush of hot stocks and hot sectors. But over the long run, diversification has a much better chance of leading to a healthier, happier financial outcome by mitigating the risks that come with concentrated portfolios. Want to know if you’re portfolio is adequately diversified? Reach out and we’ll give you a 2nd opinion.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.