If something happens to you, does your family know all your passwords and assets? Create your estate folder today. Here's a list.

Preparing to Receive a Stress-Free Inheritance

As we traverse through life, there inevitably comes a time when we may find ourselves inheriting assets. Whether it be real estate, financial investments, or valuable possessions, this transition of wealth is a gift which can also present unique challenges. Helping clients through this emotional process requires experience and patience. If I could share a few things on what to expect regarding inheritance, I think it could help make the process a bit easier and maybe help you prepare a bit better. Whether it is your own estate plan, or you worry about your extended family, use this information to help create a discussion about how you can prepare everyone for the two certainties in this world: death and taxes.

Do they have an estate plan?

Inheriting assets often involves navigating a web of legal and financial complications. Understanding estate taxes, probate laws, and transfer regulations can be a daunting task. Let’s say a family member passes away (not your spouse). You realize they never made an estate plan, no will, no documents to say where the assets should go and who is in charge. The state’s probate laws step in and they will decide how to distribute assets.

There is a lot of uncertainty in this process and if I were you, I would avoid it by preparing ahead of time. Even if the distribution goes in your favor, the process itself can take several months if not years to complete. Not to mention having to use your limited resources of time and energy. I have witnessed far too many family members become overwhelmed by being executor on an estate while simultaneously having to work full time and possibly manage a family too. It is a lot to take on.

So many institutions

If your spouse or family did not consolidate their assets before passing, you might find they may have accounts scattered everywhere. CDs at various banks, EE bonds, multiple banks with several accounts, not to mention old retirement accounts at various institutions. What does this mean for you? A lot of time and energy.

Each individual account or institution requires a death certificate, paperwork and usually several calls to resolve the settlement. Multiply that by each account the owner had and you have several hours and stress ahead of you. I have had several clients over the years that have spent more than a year trying to resolve a family member’s estate because of the sheer amount of opened accounts. Consider discussing this with your family and your financial team. They can act now to make this as easy as possible for you and your loved ones.

Taxes

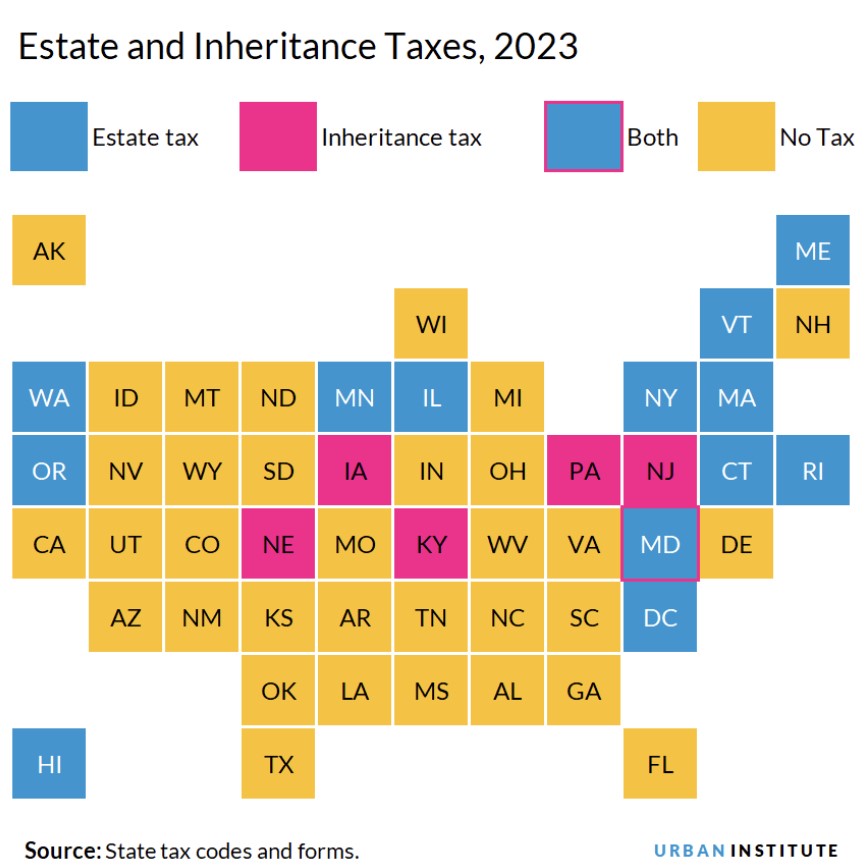

One of the biggest questions I often get when someone just discovers they are inheriting assets is ‘how much will I owe in taxes?’. And of course initially the answer is it depends. As of 2023, an estate would not have to pay federal estate tax as long as it is under the exclusion amount of $12,920,000. This is set to be cut in half by 2026 under the current legislation. It is important to keep up with your financial team on potential changes. Also, some states have an estate tax AND/or an inheritance tax. It is important to review with your team whether or not these apply to you before you do anything.

Even if the estate is in a state with no taxes and you are under the federal estate tax limit, you still have to think about taxes on the investments themselves. You or a financial professional should know about step up basis and if or how it affects you. It also may affect how accounts like annuities or IRAs are taxed and when you are required to take the money out. These decisions can make a big impact on your income and expenses. When the time comes, adding these elements into your financial plan to project how the income will affect you over time will be essential to maximizing your dollars.

Emotional Toll

The burden or pressure to ‘do right’ with the assets can carry guilt for some. Do you worry that your benefactor would approve of your choices? I have worked with several clients who were afraid to make changes to a portfolio because their spouse or parent originally purchased the investments and may have had an emotional attachment to them. No one wanted to sell Dad or Grandpa’s GM stock, especially if they worked there for decades. But now those investments aren’t serving the same purpose as they once did. By not selling them, you could put the inheritance at risk.

Don’t make any major changes too soon. Inheriting assets can evoke a whirlwind of emotions. The loss of a loved one, coupled with the added responsibility of managing their assets, can be overwhelming. It is crucial to take a step back and allow yourself time to grieve before delving into the intricacies of the inheritance. Seek support from family members, friends, or even professional counselors who can offer guidance during this emotional time. They can help you know what NEEDS to be done now and what can wait a while.

Especially for spouses – give yourself time to grieve before making big changes such as moving, or an irrevocable investment decision that can’t be altered. Sometimes we need to take a step back and have time to process. Time to figure out what life looks like now.

Have a Team

Inheriting assets can be a bittersweet experience, with both challenges and opportunities accompanying this transition of wealth. By tackling the emotional, legal, financial, and interpersonal aspects thoughtfully, you can navigate these challenges successfully and ensure a prosperous and secure future for yourself and your loved ones. Our team at CAM Investor Solutions has helped families prepare in advance as well as after loss. We know how delicate of a time this is. Having the right help will give you peace of mind and solid financial decision making so you can focus on the important things.

Disclosure

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.