If something happens to you, does your family know all your passwords and assets? Create your estate folder today. Here's a list.

Don’t Just Do Something, Stand There!

Vanguard founder John Bogle once famously advised investors on how to handle stock downturns: “Don’t just do something,” he said. “Stand there!”

It is a wry and wise way of turning the conventional wisdom about what to do in bear markets on its head. When panic grips the stock market – as it did in February and March of this year – the gut instinct of investors is to do something. Sell. Flee. Run. Protect. Move. All of these survival instincts that lurk in the back of our brains during calm markets come rushing to the front when stocks swoon and we fear our financial security is in jeopardy.The great irony of investing, though, is that our instincts are almost always wrong. Emotion is the enemy that leads us down stray paths and into a place of chaos and confusion. Creating a successful long-term investment strategy is all about process; it is a logical and methodical exercise that requires planning, prudence and discipline. And when our survival instincts kick in, our anxious brains don’t want to hear anything about planning or prudence or discipline.Overcoming this urge to take action is made doubly hard by the endless stream of bad advice that permeates the airwaves and websites when the market plunges. The talking heads tell us to “take some money off the table” and “shift assets into defensive stocks” and various other bear-market tropes that are all just market timing masquerading as sound investment strategy.

The Importance of Having an Investment Philosophy

Alas, the majority of the investing public heeds this bad advice and flees the stock market for the perceived safety of bonds and cash, only to miss the ensuing recovery that occurs when everyone least expects it. We saw this vividly this past February, when U.S. equity funds saw $17.5 billion in outflows, while money-market funds saw $31.4 billion in inflows. (Source: Morningstar, Inc.). Predictably, and sadly, those investors were on the sidelines when stocks staged their dramatic turnaround beginning in late March. In a span of just 10 weeks, from March 23 to June 8, the Dow Jones Industrial Average gained a stunning 48.30%, but all of those investors who fled to cash missed out on the recovery.Typically, these investors only dip a toe back into stocks when they perceive things to have calmed down. But by then the recovery has passed them by, and they only experience a long period of stagnant returns or, worse, another market downturn. This is known in the investment business as “getting whip-sawed” and it is all-too-common an experience for many investors. As a result, they conclude that the stock market is rigged or somehow stacked against them, ignoring the reality that it was their own behavior – not the stock market – that caused them to incur steep losses.This wrong but widespread belief can be seen in numerous articles that have cropped up in recent months. One particularly egregious example we saw last week carried the headline, “The Stock Market is a Ponzi Scheme.” It pointed to various deceptions and frauds that have caused companies and investment products to fail, wiping out their shareholders in the process.

There is no denying that frauds and deceptions come and go in the financial markets. In the past two decades we have seen accounting frauds at WorldCom, Enron and several other huge conglomerates that have bankrupted the companies and wiped out their shareholders in the blink of an eye. Just in the past few weeks, a $2 billion fraud was revealed at Wirecard, a global payment processor, that sank the company and its stock.The skeptics love to point to these unfortunate incidents as proving their assertion that the market is rigged and unfair to individual investors. What they fail to point out, though, is it was only the investors who were concentrated in these stocks who lost everything; for well-diversified investors, they were merely a blip on the radar, because the broad stock market isn’t impacted over the long run by the fates of individual companies. In fact, it is the nature of a free-market that companies are constantly coming and going within the ecosystem.

The buzzword in the start-up world these days is “disrupt” – meaning that small tech companies are seeking to disrupt larger, entrenched companies and industries that are vulnerable to innovative new technologies and strategies. Uber, Airbnb, and Venmo are but three of the more high-profile start-ups that have disrupted entire industries and the legacy companies within them. Meanwhile, venerable old-line companies with huge capital requirements such as Hertz and Neiman Marcus have filed for bankruptcy in recent weeks as their business models became unsustainable during the COVID-19 shutdown.This dynamic of innovation displacing stagnation has been going on since free markets began; it should be embraced, not feared, because it is the fuel that propels the stock market ever higher in the long run. Diversification is the way to capture those higher returns without betting on the fates of individual companies. And with an estimated 630,000 public companies in the world, there is simply no reason to take on that unnecessary risk.

Unfortunately, most investors don’t differentiate between market risk (the risk that is inherent to stock investing) and security risk (the risk you assume when investing a large sum in an individual stock or investment product). Market risk diminishes over time; the longer your holding period, the lower your risk of losing money. Security risk, however, does not. A company whose stock has outperformed the broad market for twenty years could still go bankrupt for unforeseen reasons and wipe out their shareholders in the process.

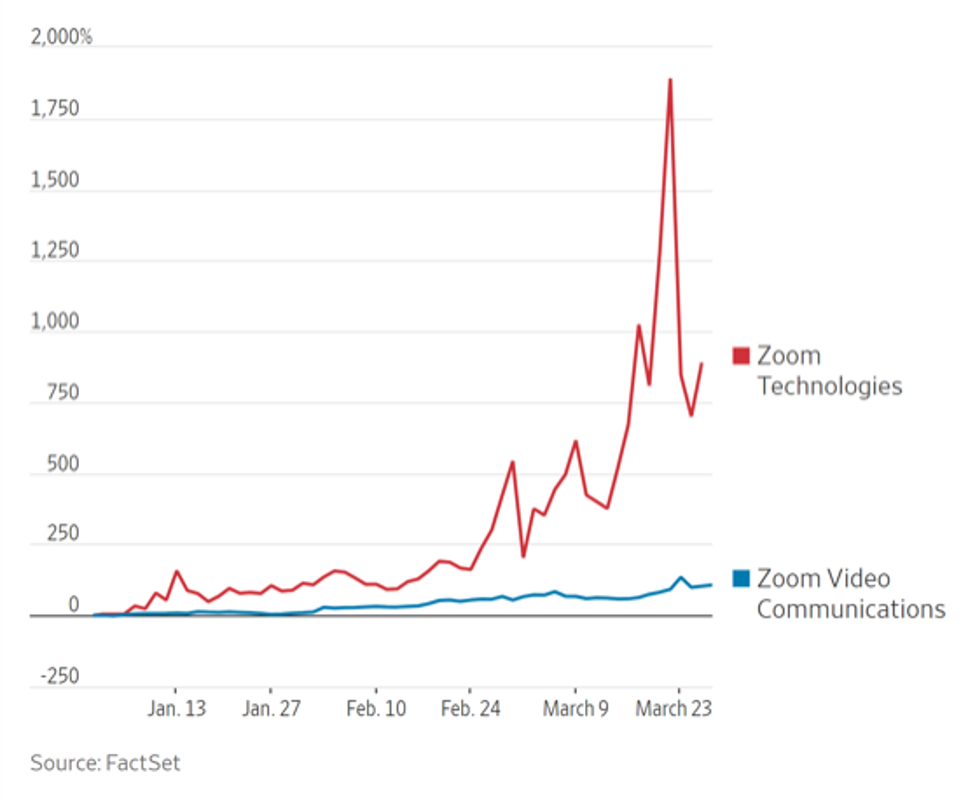

The Zoom Effect

We will close with a recent, and humorous, example of security risk. When the world went into shutdown-mode in March, video conferencing quickly became a part of everyday life for millions of people, and the phrase “Zoom call” became a part of our lexicon.

No surprise, then, that investors rushed to load up on the stock of Zoom Technologies. After all, if almost everyone is using a company’s product, it stands to reason the stock will soar, right?And soar it did. Unfortunately for those who piled into the stock, it was the wrong company. Zoom Technologies was a penny stock that, according to regulators, hasn’t made a public disclosure since April 2015 and was last known to be operating in Beijing. Zoom Video Communications is the actual company these investors thought they were buying into. But, alas, the “fake” Zoom had the good luck to own the ticker symbol “ZOOM” and that was apparently enough due diligence for many people. Frenzied investors loaded up on ZOOM, sending the stock price soaring more than 2100% in just two weeks. Meanwhile, the stock of the “real” Zoom (whose ticker is the pedestrian “ZM”) gained a mere 50% during the same period of time.

So widespread was the confusion that the Securities & Exchange Commission finally felt compelled to intervene to save these poor investors from themselves, pausing trading in ZOOM on March 27. The regulator cited “the public interest and the protection of investors” as the reason for its order. But investors continued to pile into the stock when trading resumed, pushing it up a whopping 51,000% before the inevitable plunge to earth occurred in late April. Since that time, ZOOM stock has lost about 85% of its value – whatever that value may have actually been.We are happy to report that real Zoom is alive and well.As always, we are here to help.

Best,

CAM Investor Solutions

Source: In US dollars. Stock returns represented by Fama/French Total US Market Research Index, provided by Ken French and available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html; US Government Presidential and Congressional data obtained from the History, Art & Archives of the United States House of Representatives. US Senate data is from the Art & History records of the United States Senate; Federal surplus or deficit as a percentage of gross domestic product, inflation, and unemployment data from Federal Reserve Bank of St. Louis (FRED). GDP Growth is annual real GDP Growth, using constant 2012 dollars, as provided by the US Bureau of Economic Analysis. Unemployment data not reported prior to April 1929; Dimensional Fund Advisors; M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees. This blog has been provided solely for informational purposes and does not represent investment advice or provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy. Any stated performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Charts and graphs provided herein are for illustrative purposes only. There are many different interpretations of investment statistics and many different ideas about how to best use them. Nothing in this presentation should be interpreted to state or imply that past results are an indication of future performance. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.