Discover the power of strategic financial planning. Invest with purpose, avoid speculation, and achieve your financial goals with tailored strategies.

How to reduce your investment taxes

High net worth investors often face significant challenges with taxes. While tax rules and rates may change over time, the value of keeping taxes in mind when making investment decisions does not. The reason? Investment taxes, such as capital gains and ordinary income, can reduce your portfolio returns from year to year, potentially jeopardizing your long-term goals.

While many solutions attempt to reduce some of these taxes, a solution such as a defensive tax aware strategy can be one way to mitigate this impact. A defensive tax aware strategy optimizes your portfolio for after-tax returns, helping to preserve and grow wealth more effectively in a tax-efficient manner.

Is this strategy for you?

Are you’re wondering if your portfolio could benefit from this type of strategy? Below are typical reasons investors might consider a defensive tax aware strategy:

- Tax Efficiency: This approach is designed to optimize after-tax returns, which is crucial for taxable accounts. While it may use tax loss harvesting to offset capital gains, it may also allow investors to offset a considerable portion of their ordinary income, which include dividends, interest, and employment income. All of these are ways it can reduce the portfolio tax burden.

- Risk Management: The strategy aims to reduce volatility by balancing long and short positions, making it suitable for those seeking more stable returns.

- Market Exposure: It provides exposure to equity markets while attempting to mitigate the downsides through defensive positioning.

- Investment Growth: While focusing on tax efficiency and risk management, it still targets capital appreciation, aligning with long-term investment goals.

Sound like what you’re looking for? Keep reading and let’s get into what a defensive tax aware strategy is.

What is a defensive tax aware strategy?

A defensive tax aware strategy focuses on investing in high-quality, reasonably priced stocks while shorting (short selling) high-risk, expensive stocks. This approach aims for moderate market exposure and targets tax efficiency by strategically realizing losses to offset potential gains, thus reducing the investor’s overall tax burden.

These investments are designed for taxable investors seeking equity market returns with lower volatility and improved tax efficiency. It differentiates from tax-agnostic strategies by incorporating tax-aware rebalancing, aiming to enhance after-tax returns without significantly altering pre-tax performance expectations.

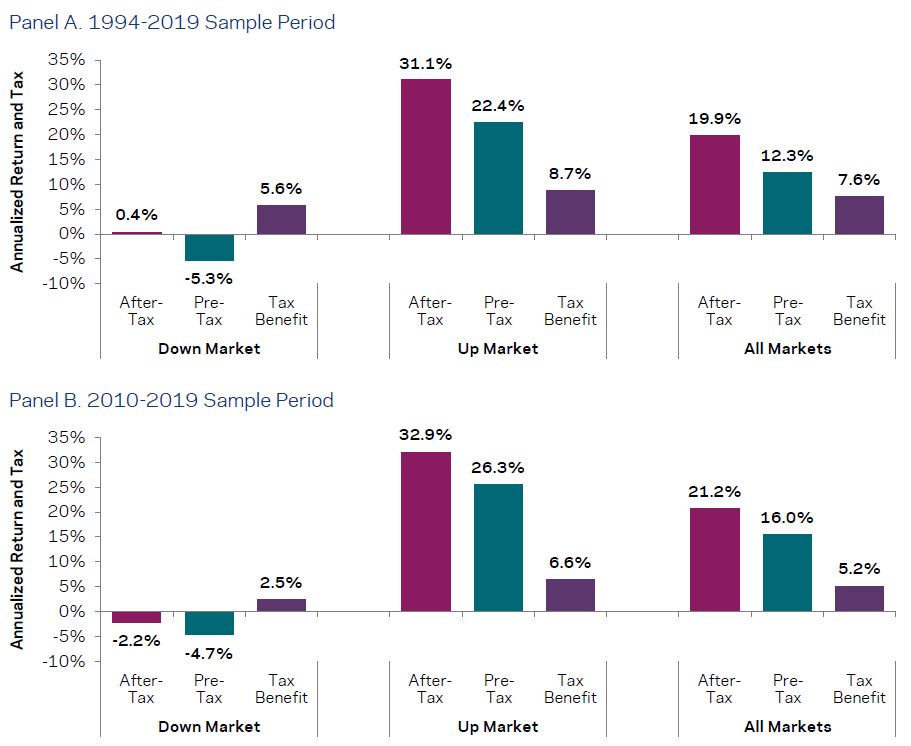

The below chart shows hypothetical after-tax returns of a defensive tax aware strategy during different market conditions. As you can see there is a significant difference between the pre and post tax returns – which is due to the tax benefit produced by the strategy. The exact mechanics of how a strategy like this works is more in-depth than we have space for here. It can also vary for every investor depending on timing, tax bracket, and many other factors. However, if you’d like a deep dive, you can learn more in this white paper.

Hypothetical After-Tax Returns of a Defensive Tax Aware Strategy

See disclosure for full source information.

The strategy in practice

Let’s look at an example to help understand how this investment strategy works.

Courtney is a business owner and has a large taxable account with roughly $3 million invested in securities with mixed holding periods. He has held some of his investments for less than a year while others for more than one year. Courtney wants to save taxes when he sells these securities at a gain. So, he asks his financial advisor to implement a defensive tax aware investment strategy. Courtney’s advisor buys shares (takes the long position) in companies that are undervalued (reasonably priced) and expected to grow (high quality). At the same time, he also bets against (sells short) shares of overvalued (pricey) companies expected to decline (low quality).

A defensive tax aware strategy utilizes these positions to minimize risks and market exposure. When certain shares lose value, his advisor may sell them to realize a loss. A realized loss can be used to offset other taxable gains, which are preferably short-term gains that have a higher tax rate.

This approach can help the investor’s portfolio be optimized for after-tax returns, making the investment more efficient tax-wise, without drastically changing the expected pre-tax investment outcomes.

Add tax planning to your portfolio

You may have heard the phrase “Don’t let the tax tail wag the dog.” And we truly believe that at CAM. However, we also find the benefits of tax planning and tax advantaged investing when constructing an investment portfolio. If you would like to discuss how we can help you become more tax aware as you look to have a successful investment experience, please reach out.

Disclosure

Source: AQR “Understanding a Tax-Aware Defensive Equity Long-Short Strategy”; April 17, 2020, Nathan Sosner, Ted Pyne, Joseph Liberman, Steven Liu; See Appendix A for details on the simulation.

Tax benefit is the potential federal tax benefit (liability if negative). Potential federal tax benefits and after-tax returns assume no state taxes and assume that the tax payer has sufficient business or other income, long-term capital gains, and short-term capital gains from sources outside this portfolio to offset any net deductions, long-term capital losses, and short-term capital losses, respectively, realized by TADELS. Hypothetical returns are net of transaction and financing costs but gross of management fees. Broad-based securities indices are unmanaged and are not subject to fees and expenses typically associated with managed accounts or investment funds. No representation is being made that any investment will achieve performance similar to those shown. Hypothetical data has inherent limitations, some of which are disclosed herein.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.