Are you a W-2 employee but your employer doesn't offer a 401(k) plan and you want to save for retirement? Read about your options.

Retirement Countdown – Social Security & Medicare

You’ve worked many hard years and you’re ready to officially “clock out” for good. And you’ve been paying into retirement costs the whole time – Social Security and Medicare. So let the retirement countdown start and check off the days until you can take a break, enjoy some hobbies.

As we discussed in our blog last week, Retirement Countdown – 5 Years Out – there are many ways to pay for retirement and the most frequently though of way is through Social Security. Likewise, most people think about paying for medical cost through Medicate. After all, the average cost of healthcare for a retired couple age 65 that will live to 85/87 is roughly $285,000. So what do you really need to know about these two government benefits before you start planning for your retirement in the next 5 years?

Social Security

Like it or not, you and Uncle Sam will work closely together during retirement. Taxes, Social Security, Medicare, your retirement accounts – he has a say in all of it. Learning the rules to the game is key if you want to maximize the value of every opportunity and avoid costly missteps.

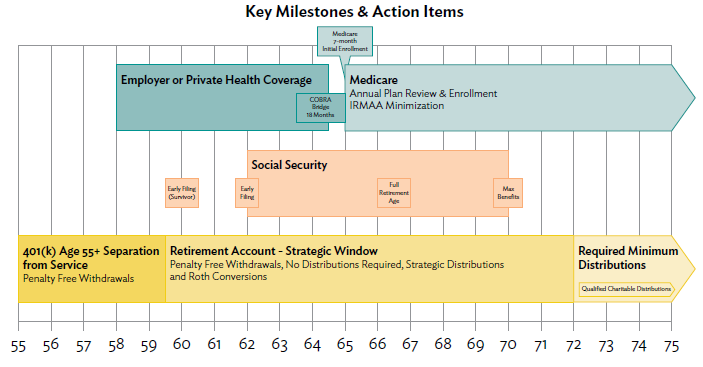

There are numerous rules, elections, and key dates in your partnership. It can be very difficult to keep all of them straight. The following graphic can serve as a handy reference to clearly plot them out for you.

Several factors play into the decision of when to claim Social Security, including life expectancy, other sources of income, retirement age, spousal benefits, and survivor benefits. Social Security planning is critical in virtually all retirement plans because total lifetime benefits can amount to a six- or seven-figure sum. Given that importance, people need to avoid making an emotional decision or one based on simple rules of thumb. Many times, people focus on a break-even date, but it’s more complicated than that. One of the things Social Security provides is a hedge against the probability that you and/or your spouse live a long time; it’s not just a math equation.

On top of that, if you’ve been married, are currently married, or considering marriage, it’s not just a single life decision. There are really two life expectancies. You may have a situation where the older spouse is in poor health and there’s a desire to claim early. It may make more sense to defer claiming Social Security and max out spousal benefits and survivor benefits for the younger spouse. The most common ages people begin to claim Social Security are age 62, 65, and at retirement. There’s nothing strategic about those points in time. To make the most of your benefits, you’ll need to think more strategically. Think about Social Security in conjunction with your spouse and the rest of your financial life.

What’s the right age?

Full retirement age, or FRA, is the age when you are entitled to 100% of your Social Security benefits, which are determined by your lifetime earnings. You can file as early as 62, but FRA is usually between 66 and 67. Social Security benefits generally max out at age 70.

If you defer your claim beyond FRA, benefits will increase by about 8% per year. This can provide a big boost to your long-term retirement cash flow. Claiming benefits before FRA will reduce them by 6-7% per year. Both the reduction and increases will impact your benefit for the remainder of your lifetime.

Married couples will be entitled to spousal benefits. You are not able to claim both a spousal benefit and your own retirement benefit; your benefit will essentially be the higher of the two. A spousal benefit is based on 50% of your spouse’s FRA benefit and can be reduced further if you claim prior to your own FRA. Deferring spousal benefits beyond FRA will not provide any further benefit increases.

Divorcees can claim ex-spousal benefits if the marriage lasted at least 10 years, they are at least age 62, and remain unmarried. Your ex-spouse is not impacted in any way by that claim. If your spouse (or ex-spouse of 10+ years) has passed away, you will be entitled to survivor benefits.

Medicare

Medicare enrollment begins three months before the month of your 65th birthday and ends three months after. It is critical to evaluate your initial enrollment decision, as there may be penalties and lifetime consequences if you do not enroll properly. Consult with a reputable and recommended insurance agent. Their commissions are typically built into premiums whether or not you use an agent, so it is no added cost to you.

If you are still working at age 65, it is critical to coordinate your initial Medicare enrollment with your employer provided health care. If you retire before age 65, consider your options for building a bridge to Medicare. Most commonly used are private insurance, an Affordable Care Act plan, or COBRA.

Medicare contains multiple components, or parts.

- Part A: Hospitalization coverage ($0 premium)

- Part B: Medical coverage (2023 monthly premium table below)

- Part D: Prescription coverage (premium varies, $42 national average);

Participants in Parts A and B can round out their coverage with one of the below options:

- Medicare Advantage Plan: Sometimes referred to as Part C. Typically $0 premium with a regional HMO or PPO network. Part D may be included with no additional premium. Care may be limited to regional and not available nationally. Must ask each doctor if they take your exact specific plan.

- Medicare Supplement Plan: Additional monthly premiums required. Accepted anywhere in the country that accepts Medicare. Part D is not included.

Who pays more for Part B?

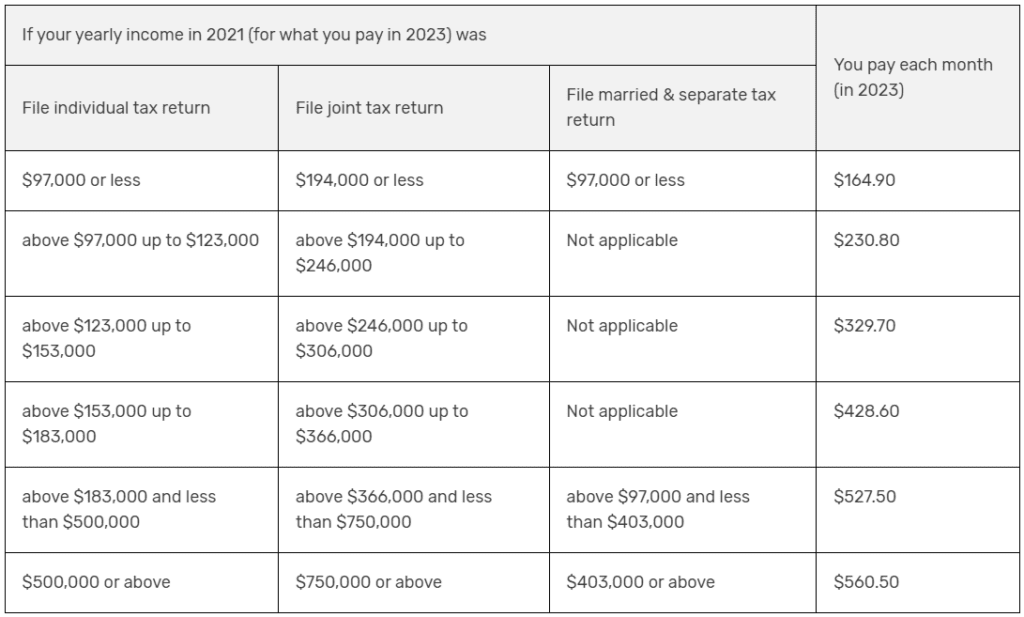

Your Medicare Parts B and D premiums are subject to increases called Income- Related Monthly Adjustment Amounts (IRMAA). As you cross certain income thresholds, you will see your Medicare premiums increase. These increases are not phased in, so going just $1 over a threshold could increase your premium by thousands of dollars. Pay careful attention each year to your Modified Adjusted Gross Income (MAGI), from which the IRMAA calculation is based. Your income from your tax return two years prior will generally be the figure referenced for your IRMAA calculation.

The website www.medicare.gov has a ton of helpful information on costs, like this chart below.

Medicare Part B Monthly Premiums

While Social Security and Medicare are big broad plans, meant to support and cover all Americans, each person is unique. Your needs, health and longevity do not match anyone else. The information in this blog is helpful and a good starting point as you plan for your retirement, but speaking with a professional can help ensure your plan is right for you. If you have any questions as you prepare for retirement, we’re here to answer them.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.