It’s been said that the stock market does not like surprises…

Should You Worry About the U.S. Debt Limit?

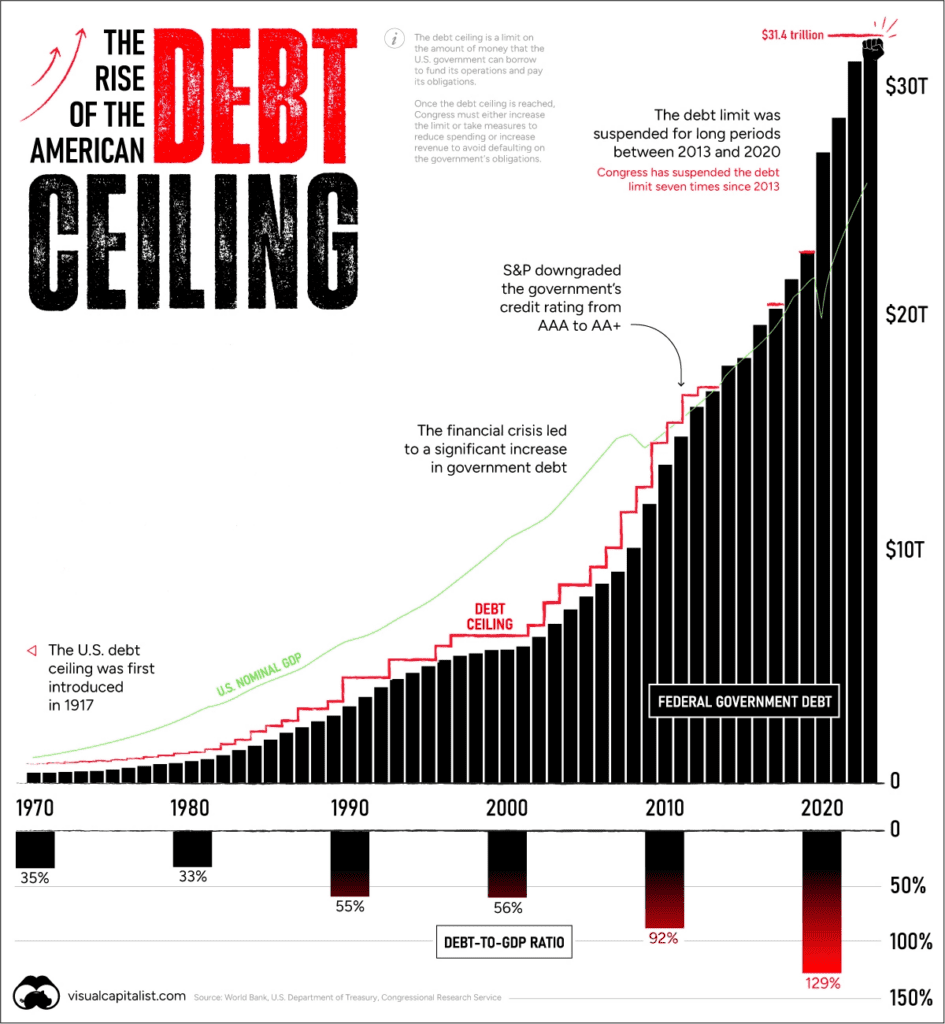

Debates over federal fiscal policy and rising debt levels, along with continued differences in views of government spending priorities, have led to a series of contentious debt limit episodes in recent years.

Key Facts

- A debt limit impasse has presented itself once again, thrusting a possible funding crisis on the United States, if Congress does not raise or suspend the debt ceiling by June.

- The “X-Date” is when the Treasury Department’s ability to finance the operations of the federal government comes to an end. This date may be as early as June 1, 2023 per Treasury Secretary Janet Yellen in her letter on May 1, 2023.

- While uncertainty around the debt limit can be unnerving for investors, we take comfort in the fact that the full faith and credit of the U.S. Treasury has always been honored. CAM Investor Solutions remains confident that a default on Treasury debt obligations is a very low probability outcome.

What is the debt limit?

The debt ceiling, also known as the debt limit, is the total amount of money the U.S. government is allowed to borrow to meet its legal obligations. Since 1960, Congress has acted 78 times to either permanently raise, temporarily extend or revise the definition of the debt limit. For the record, adjustments have been made 49 times and 29 times under Republican and Democratic presidents, respectively.

In a recent letter to Congress, Treasury Secretary Janet Yellen stated that the U.S. Treasury “will be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1st.”1 Secretary Yellen pressed that “it is imperative” Congress act “as soon as possible” on a debt ceiling resolution that “provides longer-term certainty that the government will continue to make its payments.”

In the event the debt limit is not eventually raised or suspended, the U.S. Treasury would likely face a funding crisis that could impact a range of federal commitments and strain financial markets.

What are markets telling us?

Prior debt limit episodes have historically had the largest impact on the U.S. Treasury Bill (T-bill) market. Market participants feel T-bills have a higher possibility of being negatively impacted if the debt limit is not raised on a timely basis due to the weekly maturity feature of these securities. The T-bill maturity dates would potentially be occurring right around, or right after, the debt ceiling needed to be raised. The concern is that failure to raise the debt ceiling on a timely basis could lead to a delayed payment. Interestingly, there seems to be a broad consensus that T-bill holders would eventually get paid, so it’s more of a “delayed payment” anxiety.

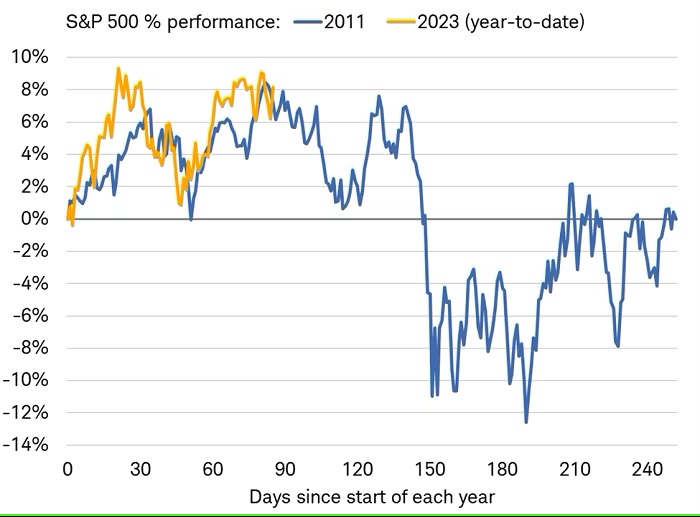

For now, stocks haven’t shown much concern over the possibility of the U.S. defaulting on its debt. You can see in the chart below that, somewhat eerily, the S&P 500’s performance this year looks very close to its moves in 2011. By no means are we suggesting this year is a repeat of the 2011 debt ceiling fight. But it’s worth pointing out that stocks’ waterfall decline that year came after the debt ceiling agreement was reached. Rather than the market scaring legislators into forging a deal, it was the U.S. debt downgrade that sparked a near-bear market in 2011.

Source: Charles Schwab, Bloomberg, as of 5/5/2023

Past performance is no guarantee of future results.

What should you do?

With all the news coverage and political drama around the looming debt ceiling deadline, it’s not surprising that many are feeling anxious. It may be helpful to remember that volatility goes in both directions—up as well as down—and that the markets are efficient at processing news. Time in the markets is ultimately better for your portfolio than market-timing.

We encourage investors to focus on the things they can control. In uncertain times, we believe it’s best to stay the course and remember to maintain perspective and long-term discipline.

Disclosure

1 Source: Treasury Secretary Yellen Debt Limit Letter to Congress, May 1, 2023

2 Source: TreasuryDirect as of May 2, 2023

Source: VisualCapitalist

Source: Charles Schwab, Bloomberg, as of 5/5/2023

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.