Working with a fee-only advisor can ensure you are objectively reviewing annuities to determine if they're right for your long-term income needs.

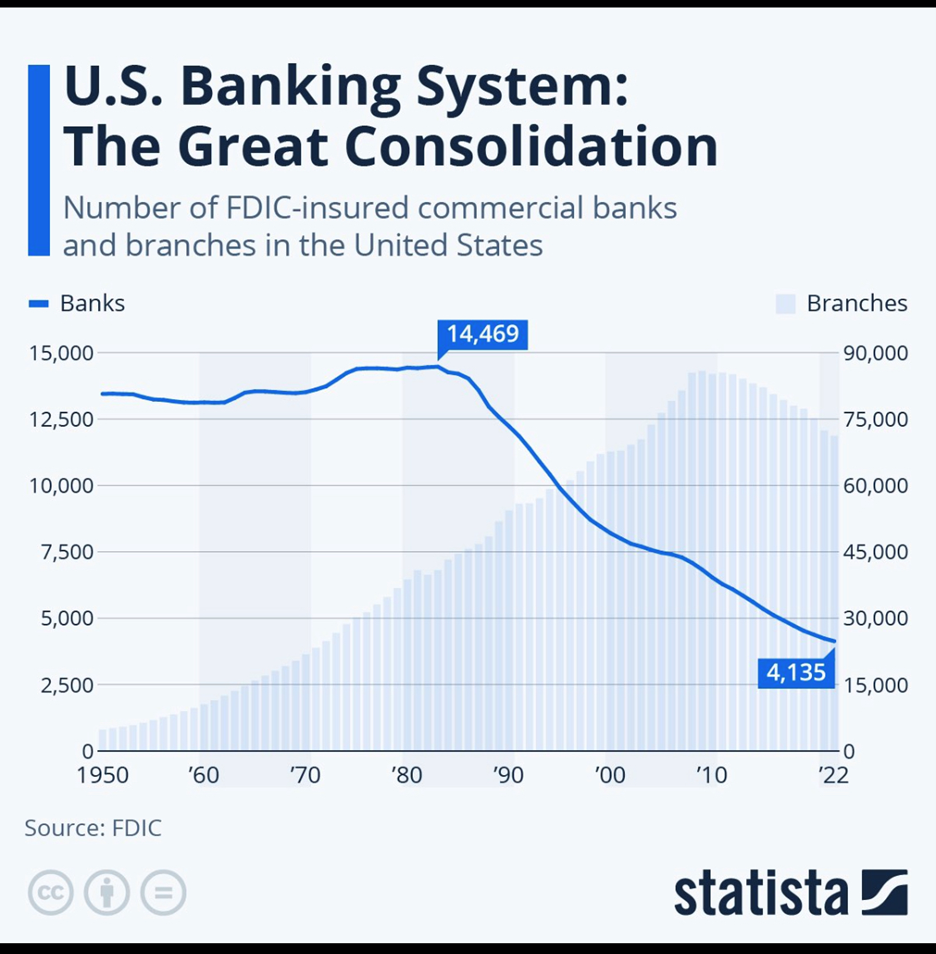

Will Your Bank Be on the List?

Banking fears are real and on everyone’s mind. Will your bank be next on the list? How do we prevent more banks from failing?

In 2022, the Federal Reserve told us they would start to increase rates to help put a lid on inflation. This year, they have kept their word and once again raised the Fed Funds rate earlier this week. This has caused some asset prices to quickly adjust (both good and bad). Its also presented opportunities to earn more yield and higher returns across various types of investments.

While higher rates continue to impact many asset prices, perhaps by accident, it has also changed the environment for many banks and how they will continue to lend to consumers, small businesses, and corporations. However, due to this rapid tightening, we’ve also seen the immediate impact on numerous banks including the recent collapse of several of the largest regional banks. Will your bank be next on the list? The image below shows that banks have been steadily closing over the past 3 decades, and it doesn’t appear to be slowing down anytime soon.

Source: Schwab; FDIC; statista

While many expect banks to stabilize in the near-term, these issues are occurring in the backdrop of the traditional banking sector that continues to be shaken by turbulence. As the failures/rescues of major regional and global banks ripple through the industry, banks are likely to become more risk averse and reduce lending not just to small businesses and consumers, but also middle market and larger corporations. In addition, the public failures of some banks may drive consumers away from traditional banks and towards alternative financial options, potentially creating opportunities for alternative lending platforms and higher yielding investment opportunities.

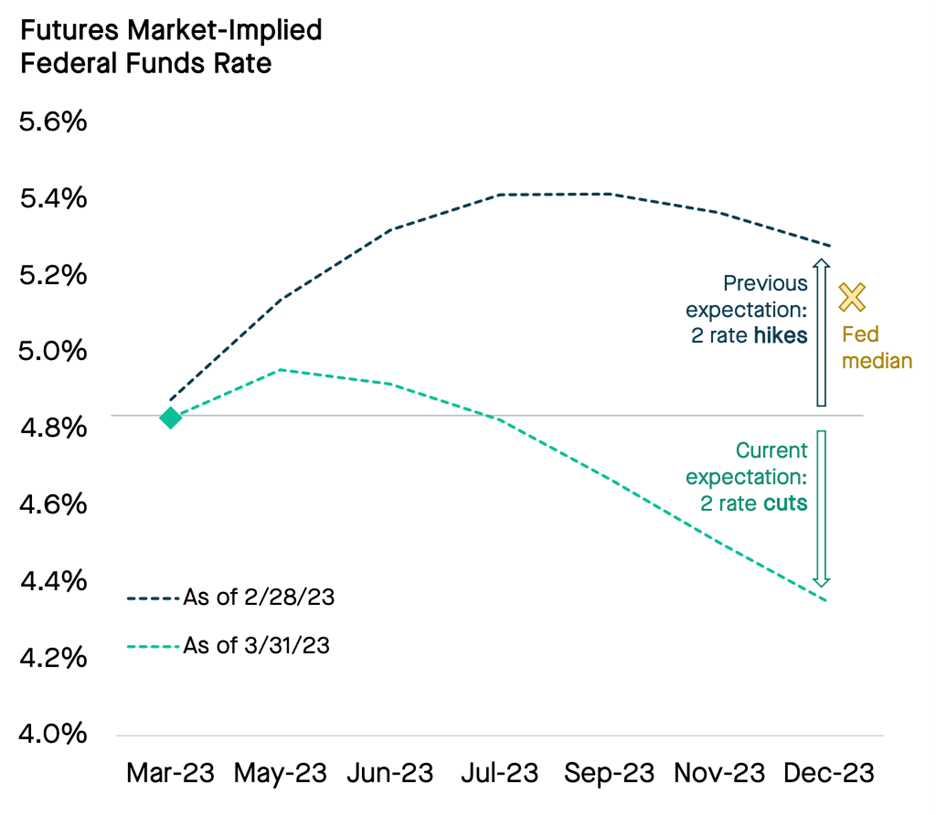

The banking instability has also rapidly reset market expectations for the future Fed funds rate path, from a ~50 basis point hike by the end of 2023 to a ~50 basis point cut (image below). The latest market expectations may be too optimistic, relative to the Fed’s median expectation of 5.1%. The Federal Reserve has maintained the continued need to squeeze inflation, but the divergent view on rates by the Fed and markets can result in heightened bond market volatility if the market returns out to be wrong. The labor market also remains robust (unemployment near historic lows), supporting consumer lending as a refuge from market instability. However, we are seeing the effects of interest rate tightening in the data.

Source: Bloomberg, as of 3/31/2023. Stone Ridge Asset Management. Market-implied is based on federal funds futures market. Fed median is based on the Federal Reserve’s dot plot.

Should you worry?

With this new outlook that the Fed will not continue to raise rates, there is hope for banks. The speed at which these rate hikes have continued has been too fast for banks to react and position themselves appropriately. Now they have a little room and time to breath, learn from the failures and plan for the long term. Still concerned your bank will be next on the list? Be sure not to have more than $250,000 deposited at a single bank ($500,000 if your a couple). Our federal banking system is strong and cash up to these amounts is FDIC insured. Want to do more with your cash? Investing is a great alternative! Save what you need and put the rest to work for you.

Disclosure

Sources: Schwab; FDIC; statista

Bloomberg, as of 3/31/2023. Stone Ridge Asset Management. Market-implied is based on federal funds futures market. Fed median is based on the Federal Reserve’s dot plot.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.