"Do not mistake a confident explanation for an accurate prediction" - James Clear. It's important to remember this when reading the news.

Tis the Season – for Forecasting!

It’s that time of year again. Cooler weather is upon us. Colorful lights are starting to pop up on rooftops. The kids are excited as they count down the remaining days of their fall semester. You guessed it. It’s market forecasting season. Every year around this time, we begin to see “expert” forecasts on where the market will go next year. Many investors rely on these predictions to inform their portfolio positioning. The problem? No one is very good at consistently getting these forecasts right.

Were the experts right?

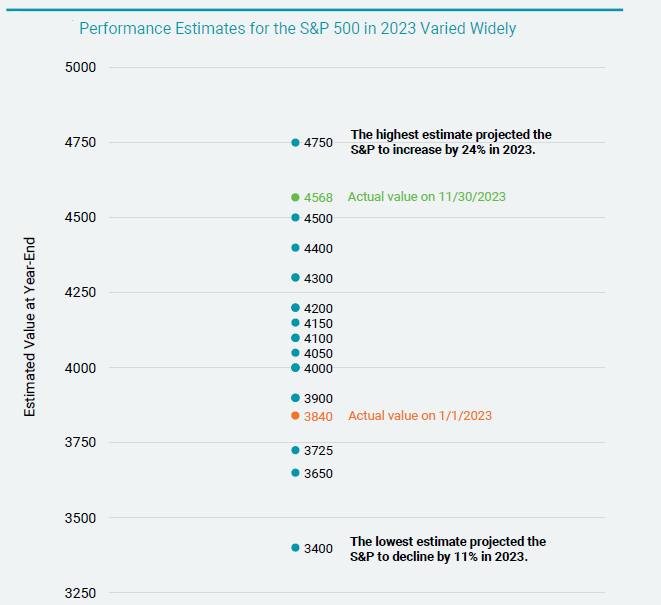

We looked back at past forecasting from industry strategists to offer some perspective. There tends to be a wide range of projected outcomes across strategists. Did you have a predication for how the S&P 500 Index would perform in 2023? Maybe you just had a feeling on how it would go based on news and media. Let’s see what the strategists predicted for 2023.

The chart below provides an example that plots 23 firms’ estimates of the S&P 500® Index level at the end of 2023.

Investing.com, December 27, 2022

As you can see, many strategists were quite pessimistic about the S&P 500 Index’s performance for 2023 at the end of 2022. Even with all their experience, research and insights they were not able to predict the great year the market has had.

Predicting intentionally (i.e., due to overconfidence) or unintentionally (i.e., due to fear) what will happen the next day, week, month or year with the stock market steers us from looking at our investment journey as a whole.

Forecasting the market based on short-term predictions with no predictive power can potentially leave us worse off versus focusing on expectations based on the rich history of empirical data.

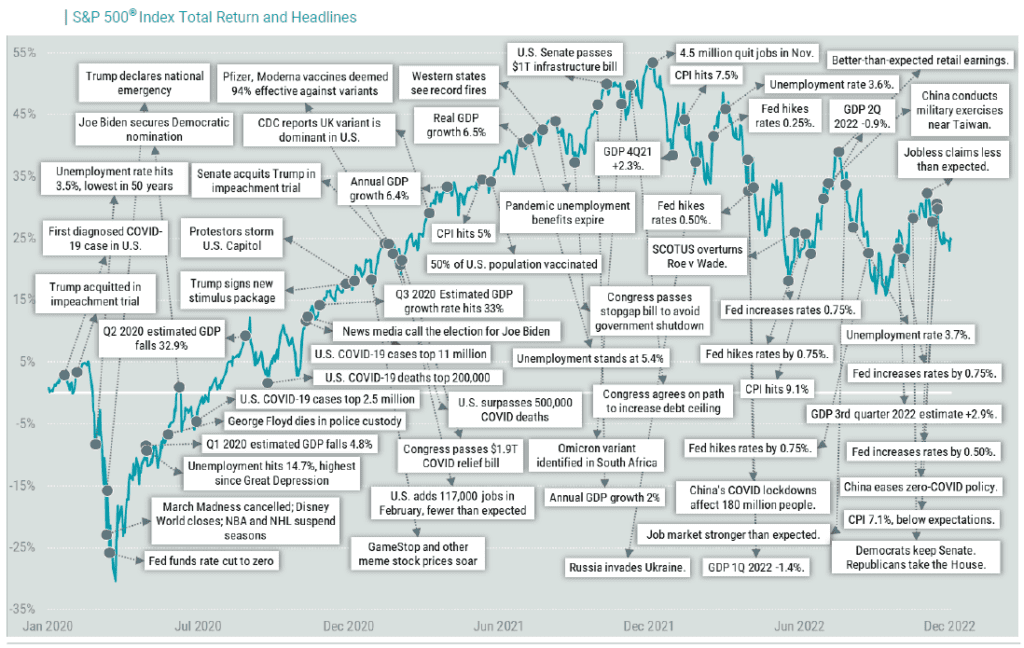

Remember, previously unexpected news and uncertainty will push markets up and down, as shown in below for the last three years of the S&P 500 alongside notable headlines.

Recognizing that ups and downs are a reality of investing but focusing on the big picture can help us avoid the temptation and pitfalls of trying to forecast markets. Need help tuning out the noise so you can focus on what’s important to you? We can help you plan for your future and stay attuned to the market but not be emotionally driven by the headlines and forecasting.

Disclosure

1. Data as of 11/30/2023. Source: Senad Karaahmetovic, “Top Wall Street Strategists Give Their S&P 500 Forecasts for 2023,”

Investing.com, December 27, 2022. Number of forecasted levels in the chart is less than total firms represented due to

duplicate forecasts. Estimated returns are based on the S&P 500 Price Index.

2. Data from 1/1/2020 – 12/31/2022. Source: FactSet, Avantis Investors. Past performance is no guarantee of future results.

M & A Consulting Group, LLC, doing business as CAM Investor Solutions is an SEC registered investment adviser. As a fee-only firm, we do not receive commissions nor sell any insurance products. We provide financial planning and investment information that we believe to be useful and accurate. However, there cannot be any guarantees.

This blog has been provided solely for informational purposes and does not represent investment advice. Nor does it provide an opinion regarding fairness of any transaction. It does not constitute an offer, solicitation or a recommendation to buy or sell any particular security or instrument or to adopt any investment strategy.

Past performance is not a guarantee of future results. Diversification does not eliminate the risk of market loss. Tax planning and investment illustrations are provided for educational purposes and should not be considered tax advice or recommendations. Investors should seek additional advice from their financial advisor or tax professional.